What is Equity Value?

In short:

Equity value is the total value of a company attributable to common shareholders, often also referred to as market capitalization. This value is important to common stock investors as it is a direct representation of what they are willing to pay for the business. There are two approaches to calculating equity value, the first and quickest is to multiply the current share price by the number of outstanding shares. The second more complicated way is to start with a company’s enterprise value subtracting out liabilities and other equity investors’ interest (ex. Preferred stock) then add back cash.

Formula:

In-depth:

When talking about the value of a company two basic questions need to be answered. The first is the value to whom and the second is how is the value calculated. For example, almost all companies have debt investors. The interests of the debt investor are different than that of equity investors. Debt investor’s main interest is that the company pays its debt payment which naturally makes the debt investor more risk-averse since the reward for additional risk is limited.

Based on who the value is referring to will impact how value is calculated. Looking at enterprise value which is the value of the main business operations to all investors, cash would not be added into the calculation as it is not part of the core business operations. However, with equity value which refers to common shareholders, cash would be added in as the cash belongs to those investors.

One additional way to calculate value other than equity value is to calculate book value which represents the assets less liabilities as listed on the balance sheet. The book value belongs to the equity investor however is not the same as the equity value. The difference is that the book value is just the net value of the assets a company has and does not account for the cash flow they may bring the company. It should also be noted that the book value can be positive, negative, or zero while equity value cannot be negative. Equity value is often much higher than book value as equity value is factoring in earnings.

Where to find equity value information?

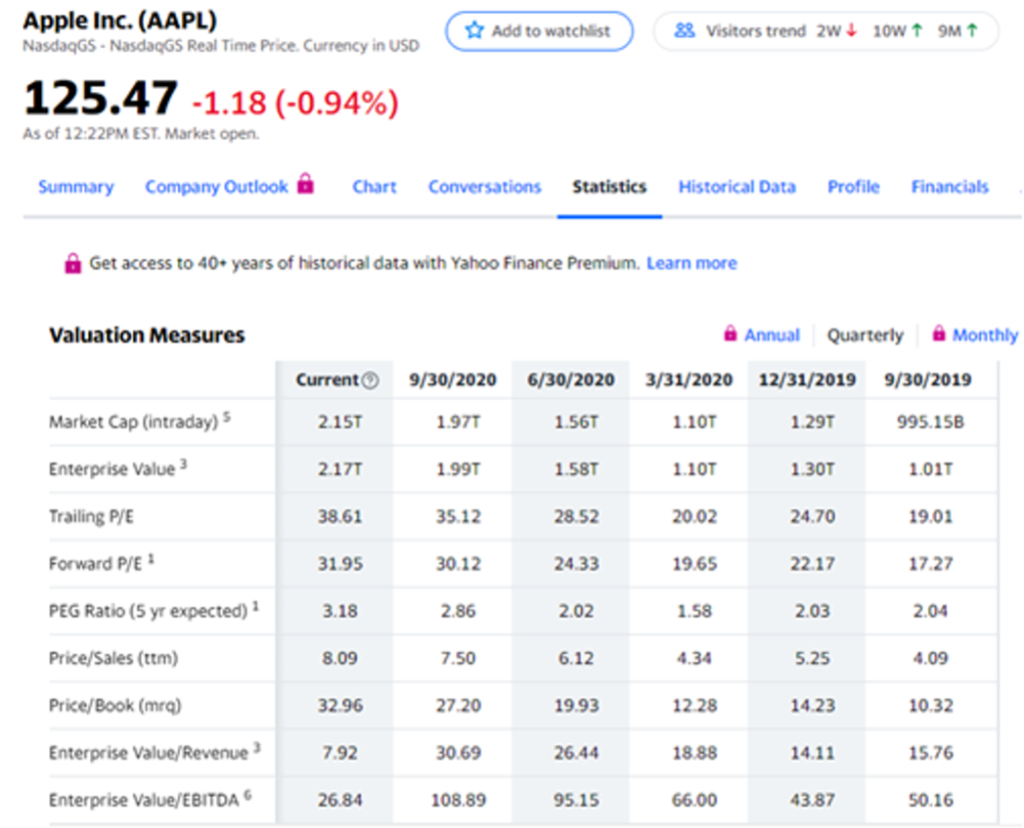

Already calculated equity value can easily be found on many online stock data sites, we’ve included a list of a few sites below.

Simply visit one of these sites, enter a stock quote then look for “summary”, “key statistics” or something to that effect. You should see “Market Cap” which may be close enough for most quick applications.

For more detailed equity valuations, diluted equity value may need to be calculated. Diluted equity value accounts for additional shares which would act to dilute the value to the current equity value to common shareholders. Examples of dilutive shares could be stock options, warrants, convertible bonds, etc. In the case that an investor wants to calculate the diluted equity value quickly, they would need to go to the company’s 10k and find the count of all possible dilutive shares then add that number to the number of outstanding shares. To calculate the dilutive effect more specifically an investor may use the treasury stock method, accounting for the company repurchasing shares from say exercised stock options.

Where to find 10k information:

Finding the financial statements of a publicly-traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html . This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Frequently Asked Questions

Equity value, also referred to as market cap, is the value of the business to its common shareholders. To calculate equity value multiply the current share price by the total number of outstanding shares.

Equity value, tells us the total value of a company which is attributable to its common shareholders. To calculate equity value multiply the current share price by the total number of outstanding shares.

Enterprise value, is the total value of a business which is attributable to all investors, meaning both debt and equity investors. Equity value, is the total value of a business which is attributable only to equity investors, meaning common shareholders.

Equity value per share is simply the current market price of the shares. This is different than book value per share which is found by subtracting total liabilities from total assets and dividing by the total number of shares outstanding. Book value per share and equity value per share do not tell you the same thing.