What is Market Cap?

Market Capitalization – Definition, Use, and What it Represents

In-short:

Market Cap or Market Capitalization is the current value of a business to equity investors, more precisely the value of the business to common shareholders. This is a quick way to get an idea of the size of a company for use in comparison to other companies.

FORMULA:

Uses of Market Cap

In-depth:

Knowing what a company is worth to an investor can often be a difficult task, one way to get a quick idea of what it might be worth is to take what the market says it is currently worth. This value is called the market cap and is found using the formula above. Calculating the market cap of a firm would go as follows. We have a company with 10 million shares of outstanding common shares that are currently trading at $11.53/share, this would mean the market cap for our company is $115,300,000 (10 million shares * $11.53/share).

A key point to valuation and the phrase “might be worth” from above. This phrase implies that an investor is of the mindset of an inefficient market. Meaning they believe at times the market does not value companies accurately which provides an opportunity for investment. This would also mean that the investor believes the market while being inefficient is generally correct, as such finding an “undervalued” or “overvalued” company does pose an opportunity to “beat” the market when the market corrects.

More general use: (like comparisons and risk)

Many times companies are divided up beyond just their sector, often this division is done by market cap. This division can make comparisons of companies more relevant and accurate. Consider an extreme example, comparing a small online retailer to a company like Amazon would not be useful. Why? Because the small online retailer has an entirely different operating environment given its size, this would include, risk, access to suppliers, economy of size efficiencies, access to lenders, and so on. Therefore, such a comparison would be useless even though they may be considered in the same sector.

Given the usefulness of comparing companies by size via market cap especially with regard to risk, ranges have been developed for more uniform grouping.

Large-cap

These companies generally have a market cap of $10 billion or more. Companies falling into this category are often but not always well-established companies who have been around for a long time. Often they provide more stable investments that generate returns although they may not be huge. That said, companies such as Apple (AAPL) and Microsoft (MSFT) fall into this category and they have provided better than market returns while in this group.

Mid-cap

These companies generally have a market cap between $2 billion and $10 billion. Companies in this range are often thought of as more risky yet still somewhat established with a higher potential for growth than large-cap. Examples of companies in this range are Marathon Oil Corporation (MRO).

Small-cap

These companies have a market cap between $300 million and $2billion. Companies in this category are thought to be even riskier yet, at the beginning of their life, and may offer even higher returns. Most likely small-cap companies have the least amount of access to resources which in an economic downturn could prove to be highly impairing.

Where to find Market Cap information?

Already calculated values can easily be found on many online stock data sites, we’ve included a list of a few sites below.

Simply visit one of these sites, enter a stock quote then look for “summary”, “key statistics” or something to that effect. You should see “Market Cap”. This will be the current market cap value at the time you are viewing it. This value may change while you are viewing it because the share price is changing.

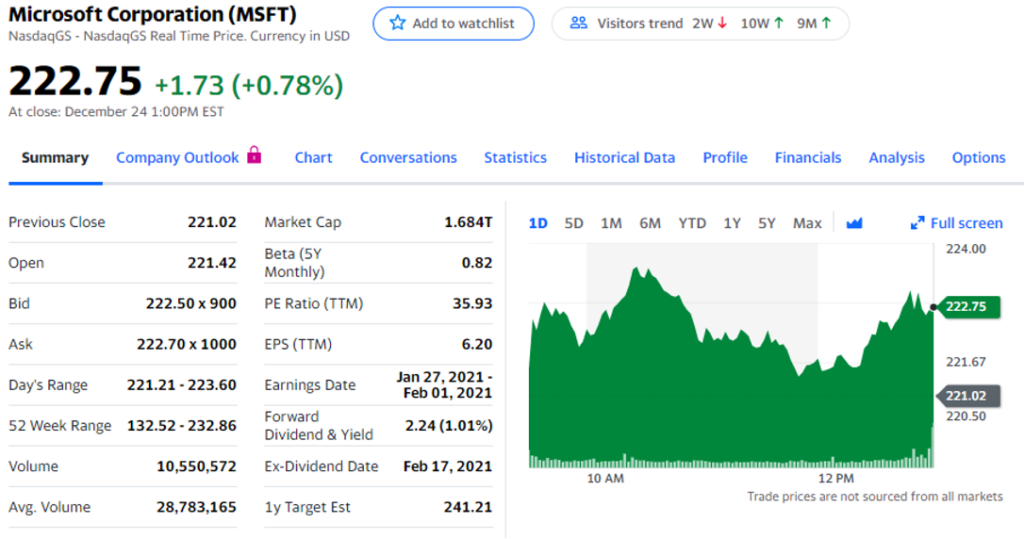

For example, we looked up Microsoft (MSFT) on yahoo finance. To the left is a screenshot, our market cap value says “1.684T”, this means the market cap value of MSFT is $1.684 Trillion. Some would call this large-cap and some would call this mega-cap, meaning it is one of the largest of largest companies in the world.

Calculate yourself this is a bit more tricky, to do this you will need to look up a company’s most recent 10-k (annual statement) and/or its10-Q (quarterly statement) to get the number of common shares outstanding. Getting access to this information on publicly traded companies is easy, simply visit EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html . This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Next, you will need to find the number of common stock outstanding. Common stock outstanding can be found on the bottom of the balance sheet. After you have the number of common shares outstanding you will multiply that number by the current share price, the result will be the market cap.

Why calculate yourself? (equity value)

One reason you may choose to calculate the market cap yourself is that you are actually interested in the company’s equity value which is commonly associated with market cap. The difference might be slight but meaningful, in equity value you want the exact number of outstanding shares plus any dilutive stock that could increase the equity value of the company (stock options, restricted stock, etc). With market cap from stock data sites, the calculation may be based on average shares outstanding (i.e. over a period of time), not precise enough.

For more information on equity value, enterprise value or implied/intrinsic valuation check out our articles on them.