Enterprise Value – EV

In short:

Enterprise Value represents the value of a company’s main business operations to all investors in the company, that is debt, equity, and other investors. Enterprise value (EV) is often thought of as a more comprehensive view of the value of a company than equity value (market cap) as it also includes equity value in its calculation. To calculate basic EV add market cap and debt then subtract out cash and cash equivalents.

FORMULA:

The reason non-operating assets (such as cash) are subtracted out is because they do not represent a core operating asset to the business. Since Enterprise value is the value of the company’s core business operations to all investors, non-operating assets should not be included in this calculation.

In-depth:

Enterprise value gives an investor a much broader look at the value and size of companies. While equity value (market cap) is quicker to calculate and shows the value of a company to equity investors, almost every company requires other forms of investors, namely debt. By only looking at the equity value to gauge company size may leave an investor with an incomplete picture. This may include the riskiness of a company given its debt/equity breakdown or its relative cost to other companies of comparable size because of this breakdown.

What may be an even stronger point to enterprise value is that the way a company funds itself (debt, equity, other) does not affect EV nearly as much as funding affects equity value. The following examples should help make this clearer.

Enterprise Value Basic Examples

Let’s look at two examples, first a basic EV calculation and second, a contrast between equity value and enterprise value. Say we want to calculate the enterprise value for a company with 10,000 common shares outstanding at $100/share. We also know that this company has $150,000 of cash and $2,350,000 of debt. From this we can perform the following calculation:

Enterprise Value = (10,000 *$100) + $2,350,000 – $150,000

Enterprise Value = $3,200,000

We also know equity value:

Equity Value = (10,000 * $100) = $1,000,000

Now we can look at an example that demonstrates the difference between equity value and EV while demonstrating the importance of understanding EV.

Take two companies that have identical cash flow and whose equity value is both $240 million. Company A has debt of $460 million and cash of $60 million. Company B has debt of $300 million and cash of $30 million. Since cash flows are identical for both businesses, which business is actually a better deal to invest in? Company B, because the company is able to generate the same cash flow with far less funding from investors.

We can see from above that both companies have an equity value of $240 million, however, their enterprise values are different. EV for company A is $640 million while EV for company B is $510. This brings up two important points, one point being the percent of debt vs the percent of equity cannot be seen from equity value which is an important consideration in company size and riskiness.

The other point taken from above is that enterprise value is a more stable view of company value than equity value. For example, say company A can add more equity funding from issuing additional shares, the company wants to reduce its debt percentage because they believe it adds too much perceived risk. So, company A raises an additional $20 million in equity and pays down debt by $20 million. Now equity value is $260 million, an increase, but what about enterprise value? We calculate EV, $260 million + $440 million – $60 million which gives us $640 as EV, the same as it was before.

This is a major significant point of enterprise value. The EV stays relatively the same regardless of changes in capital structure whereas equity value changes much more. This advantage can be captured into valuation multiples that let an investor compare two companies while reducing the influence of capital structure/leverage.

EV Multiples

As with other valuation multiples, multiples created with enterprise value offer another view to compare like type and size companies. It should be noted though that any comparative valuation multiple is not true valuation, rather it gives an investor a quick way of comparing companies. The most common multiples used with EV below:

- Enterprise value / Revenue

- Can also be shown as EV / Sales, this gives an idea of how much an investor would be paying for a given amount of revenue.

- Enterprise value / EBIT

- Enterprise value / EBIT (operating income) gives an idea of the price of a company in relation to its operating profits. This would be an additional metric to use beyond just P/E.

- Enterprise value / EBITDA

- Enterprise value / EBITDA is similar to EV/EBIT however adds back in depreciation and amortization which results in normalizing the effects of CAPEX. This would be an additional metric to use beyond just P/E as well.

Where to find EV information

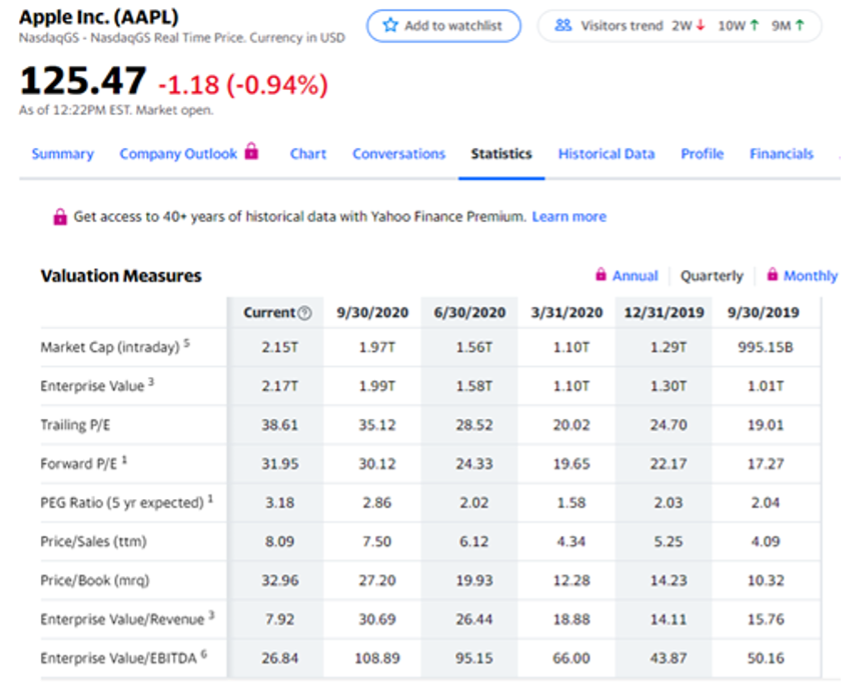

Already calculated EV values can easily be found on many online stock data sites, we’ve included a list of a few sites below.

Simply visit one of these sites, enter a stock quote then look for “summary”, “key statistics” or something to that effect. You should see “enterprise value”, in the example to the right EV is the second value below market cap.

Using already calculated enterprise values may help speed up comparisons or identifying companies of like size. However, problems with using a pre-calculated EV may come in what line items an investor believes should be used in the calculation of EV. In a deeper analysis of companies, an investor would probably want to calculate EV themselves instead of relying on this figure.

Calculate yourself

To find information to calculate the enterprise value of a company you will need to look at their balance sheet which can be found in a company’s financial statements. Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html . This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10-Q, once you find them navigate to “financial statements”.

Additional resources: What is Market Cap