What is the Income Statement?

In short:

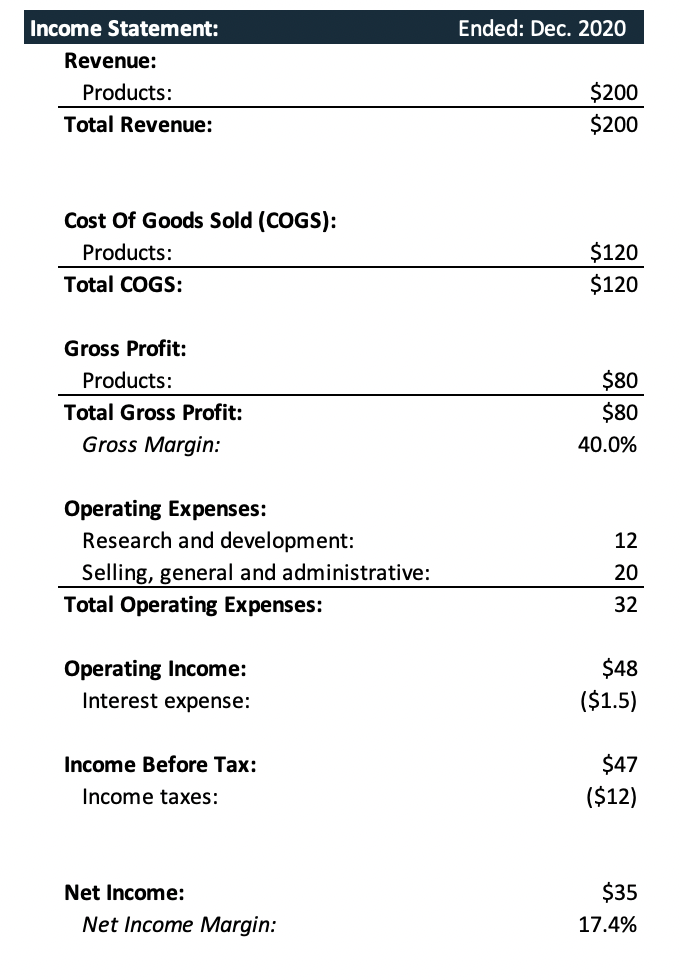

The Income Statement shows the profit and loss of a company over a period of time including both cash and non-cash items, the objective is to calculate after-tax profits. To calculate net income, total revenues are subtracted from total expenses, including both operating and non-operating categories.

Non-cash items can be included on the income statement for various reasons one would be in timing. Since revenue is counted upon delivery of a product, if an item is delivered before actually being paid for, the income statement will still show revenue for that product. The cash actually received for a product will be adjusted for on another core financial statement, Cash Flow Statement.

The Income statement is one of the three main financial statements, the other two being the Balance Sheet and the Cash Flow Statement. Altogether these statements allow for a more accurate estimation of the true cash flow of a business.

In-depth:

Non-cash items and weakness of income statement

The income statement will begin to show the profitability of a company over a period of time, this could be a year, quarter, or another timeframe. The aim of the income statement is to get to the after-tax profits of a company.

After-tax profits is a key term to understand why non-cash items are included. On the income statement there often will be many non-cash expenses added to reduce the tax bill a company has to pay. The company, like any individual, wants to pay as few taxes as possible because the less it pays in taxes the more it can invest into its business.

For example, a company may be able to use depreciation of an asset as an expense on its income statement. This expense will result in a lower net income even though there is no real cash going out for this expense. As a result, the company’s lower net income will lower its tax bill thus increasing its real cash gain. Even further, the depreciation may come from an asset that still has value to the company after being fully depreciated.

With the above information in mind we can now understand, the income statement will not show the true cash flow generating power of a company given that it includes many non-cash items and does not account for spending on cash-hungry items like capital expenditures. To truly measure the cash flow generating power of a company the most important financial statement is the cash flow statement.

Why the income statement is important

Why care about the income statement in light of these considerations? The income statement allows for the calculation of the first line item on the statement of cash flow, net income, without the income statement this crucial item could not be calculated. Even more, the income statement gives clarity to where some cash flow is being generated therefore it is not something to be ignored.

Major sections on the income statement

- Revenue: This will include the total gross revenue the company generates from its products or services. Generally, the revenue section on the income statement will be broken into products and services although this breakdown may vary by company and industry.

- Cost of Revenue: Often call cost of goods sold (COGS), these are expenses that are directly associated with a product or service. When COGS are subtracted from gross revenue you will get the gross margin. Gross margin can be useful to determine the capital intensity of producing products and where the bulk of expenses may be coming from.

- Operating Expenses: Operating expenses would include line items such as research & development, selling, general, and administrative (SG&A), etc. These are expenses that cannot be directly attributed to the production of a product or service.

- Non-core Income/Expense: Income in this section would be anything the company is not intentionally seeking as part of its business plan. For example, if a company has invested extra cash into marketable securities which pay dividends, or it rents an extra building it owns. The revenue generated from those activities are considered non-core.

- Tax: This is the final step before net income is calculated, after taxes are accounted for the result will be net income. For here many companies calculate earnings per share, that is the net income divided by the total outstanding common shares.

Useful metrics from the Income Statement

The two most commonly discussed metrics talked about from the income statement are earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation, and amortization (EBITDA). Both are often looked at as proxies for cash flow.

- EBIT: Earnings before interest and taxes are simply the operating income on the income statement adjusted if necessary for non-recurring expenses. EBIT is useful as it gives a good look at the profitability of a company’s core operations, important to note is that EBIT indirectly accounts for depreciation and amortization.

- EBITDA: While similar to EBIT, earnings before interest, taxes, depreciation, and amortization adds back depreciation and amortization. Remember when we said the income statement doesn’t accurately represent the cash-generating power of a company? Then we said this was because of non-cash expense items like depreciation. Adding depreciation back into a value such as EBITDA accounts for this, giving a better approximation for cash flow than net income. EBITDA can be tricky to calculate as not all income statements provide the information to calculate it, in which case you would look to a cash flow statement to help craft the EBITDA number.

Where to find financial statement information

Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html. This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10-Q, once you find them navigate to “financial statements”.