Short Squeeze – When many short positions are forced to buy to avoid large losses

In short:

A short squeeze is an event in which many traders with a short position are forced to buy back shares as a result of a large jump in a stock’s price. The short traders buy back their shorts to avoid greater losses by the stock’s continued move higher. Ultimately, many shorts trying to buy back shares at the same time drive up the price of the stock even more as a result of their demand.

The Story Behind GameStop – The Most Famous Short Squeeze

Probably the most famous short squeeze of all time was the 2021 GameStop/Reddit short squeeze.

Setting the Scene:

GameStop, once a behemoth of personal gaming had its last profitable year in 2018, squeaking out +34¢ of profit per share. By 2020, GameStop’s fundamentals had deteriorated at an astonishing rate, closing over 200 stores and losing -$6.59 per share in 2019 and on track to close an additional 462 stores in 2020 with losses of – $5.38 per share.

In the eyes of most investors, an established company whose earnings look like this is a clear signal of trouble and likely bankruptcy. Add in the qualitative aspect that the company’s whole business was primarily operating brick and mortar shops for products that had almost moved completely digital -computer games. It appeared they were going to be the blockbuster of this industry.

Bring in the Players

Even a company on the decline poses a potential for profit by short-selling shares. GameStop certainly seemed like a straightforward candidate for this strategy as it appeared only a matter of time. Typically, however, short-selling like this is done primarily by hedge funds or institutions as it is significantly more risky than a normal “long”.

In GameStop’s case, notable firms such as Citron Capital and Melvin Capital were among the investors holding significant short positions. That said, these we not the only firms targeting GameStop as a short. In fact, GameStop had short interest over 100% which means more shares had been shorted than were even available to the public.

Having a short interest over 100% makes the short-sellers very susceptible to the worst thing that could happen to a short seller – a short squeeze. If anything went wrong, such as better-than-expected earnings or attracting high-caliber leadership could trigger a short squeeze.

Triggering a Short Squeeze

In January 2021 GameStop announced they were adding three new directors who had massive success in the e-commerce space. They are Ryan Cohen – the founder of Chewy, Alan Attal – former head marker of Chewy, and Jim Grube – former head of finance at Chewy. The addition of this leadership brought in high-caliber talent that grew a three-person startup to a 10,000-employee business which had a successful recent IPO.

Not only did this new leadership come on as directors, but Cohen had invested a meaningful amount of his own money into GameStop. All of this could be taken as the change GameStop desperately needed and a vote of confidence from the new additions.

At this point, GameStop had the catalysts in place to trigger the short squeeze they just needed stock buyers. This would come from Reddit’s r/wallstreetbets subreddit where the recent information was picked up and eventually pushed to its several million users.

Within a few days, GameStop stock found very large buying interest from the positive catalyst in a massively shorted stock. This led to an initial spike of 50% which only brought more attention, more buyers, and more pressure on those who still held a short position.

Ultimately this entire dynamic took the stock from trading around $13 to trading at a 52-week high of $483 within a matter of days. In true short squeeze fashion, within only a short period of time, GameStop traded back down to around $40.

GameStop’s High Stock Price Aftermath

The part of the GameStop story that deviates from traditional short squeezes is that GameStop’s shares continued to trade much higher than they did before the short squeeze. The reason for this is likely due to the lingering amount of retail investor attention placed on the story since it was primarily driven by retail investors and to some extent politicized.

This continued elevated price underscores the point that market prices do not have to reflect the intrinsic value of a company – at least in the short run. Rather, market prices on any given day are a reflection of what people are willing to pay for whatever reason.

In-depth Short Squeeze Explanation:

What are short-sellers?

Short sellers are traders who believe they have found a company that is overvalued by the market. In a desire to profit from this “mispricing” the trader takes a short position, that is they sell the shares to the market. They do this by borrowing shares to sell, ideally, they will buy the shares back at a lower value profit from the difference and return the shares.

For example, think if you found a car for sale that you knew was both overpriced and still going to sell at that overpriced level. Would you not want to sell the car at that overpriced level and make the difference between what it was really worth and what you could get for it? In this case, you would need to sell the car first at the high level and then go buy it at the lower level. The general idea is simple but harder in practice.

In the stock market the short seller can go find a car at a lower level, what they have to do is wait for the market to price the stock they think is overvalued at a lower level. This is what makes short selling difficult, the market has no timeline in which it must price a company correctly. The market may never price the company at what the short seller thinks is correct, and the longer it takes the more risky and costly it becomes.

Finding short interest

Finding how much a certain stock is being shorted at a certain point in time is relatively easy. You can go to most stock data websites and find them, we’ve included a list of sites you can use below.

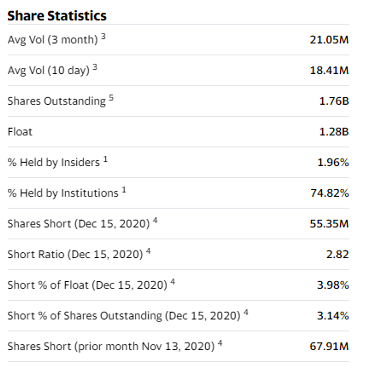

Simply visit one of these sites, enter a stock quote then look for “statistics”, “key statistics” or something to that effect. You may see a section that says “share statistics”. This will be the section that has all short share information. You may see a line that says short shares outstanding as a percentage of outstanding, this should be pretty self-explanatory.

Why is knowing this information valuable? Knowing how many shares are being shorted gives you some insight into what other market players are thinking. If there is a large amount of short interest in a particular company maybe there is a reason. Something could be wrong with the company, big negative news may be on the horizon, or maybe nothing. These market players could all be wrong as was the case with Tesla. If a company has a large amount of short interest and the company’s share price moves meaningfully higher you may be able to expect an accelerated rise in share price because the short sellers will need to cover their short position. The only way to do this is to buy adding even more buyers to the buyers driving the stock price higher.

Short squeeze example

Take a look at a constructed example, say we are looking at a rocket company called SpaceLift. The company makes money by carrying private satellites into low earth orbit.

SpaceLift is in the final process of developing its lifting rockets but things are going slow. Some market participants start to believe the company is not going to be successful and SpaceLifts share price will go to $0. Seeing that the share price right now is $50/share with 10 million outstanding shares they stand to make a big profit if correct. Soon enough short sellers pile on and drive SpacLift’s share price to $35/share. This makes even more short sellers excited who are only paying attention to share price movement and a weak trading thesis. Now SpaceLift is trading for $25/share, 50% lower than it was with short interest at 30% of outstanding.

Finally, SpaceLift pulls it off and has a successful rocket ready to go. Investors rush in seeing the company undervalued at $25/share, by the end of the day shares are trading at $32/share, 28% higher. Short sellers are panicking by now and starting to buy in order to offset their short position. The buying from the first scared short-sellers pushes SpceLift to $40/share catching the eyes of other positive investors and the cycle continues. By the time it is all done over a few weeks the price of SpaceLift is now $100/share and short interest down to 1% of outstanding.

In this example, the short squeeze was set off by the company coming through on their bet. The positive news was not in line with what short-sellers thought and attracted long investors which pushed the shorts out.

Additional Resources: What is EPS in stocks?