The Difference Between the Income Statement and Balance Sheet

Income statement vs Balance sheet

In short:

The income statement and balance sheet are different in two major points. First, the income statement shows how a business has done over a period of time while the balance sheet is at a certain point in time. Secondly, the income statement shows how well a company is doing at generating income whereas the balance sheet shows its finances, that is what it owns, owes, and what is left for shareholders.

Income statement vs Balance sheet

In-depth:

When the income statement and balance sheet are combined with the statement of cash flow they collectively represent the three major financial statements. These are the core statements which investors, lenders, and management will look at to help judge the company.

To have a stronger sense of the differences between the income statement and balance sheet we simply need to examine each.

Income Statement

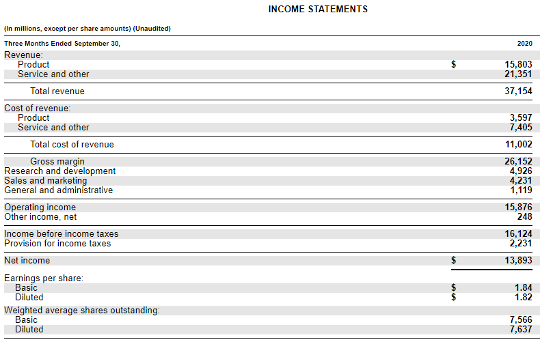

Below is a multi-step income statement of Microsoft (MSFT) from their September 2020 quarterly report. The statement can be broken into three sections, the level of detail of each section will vary based on how much information the company has to disclose. Obviously, it is to the advantage of the company to only disclose as much information as necessary. Why? Giving too much information, while convenient for investors, would provide competitors with abilities to see weak points in a company.

Section 1 – Total Revenue

This is the total revenue part, typically this will be broken down by products and services. In the case of MSFT, products could represent computers or MS Office, while services could be cloud computing. As we can see the total revenue for MSFT is over $37 billion for this quarter.

Section 2 – Cost of Goods Sold (COGS)

The COGS section will break out the cost of producing both the products and services. This information is very useful as it allows investors to see gross margin which tells many things one of which is how capital intensive is a business. For this Quarter, MSFT had a COGS expenditure of around $11 billion, or a better way of putting it is a 71% gross margin.

Section 3 – Operating Expenses

Operating expenses are all the expenses that cannot be directly tied to a per-unit product or service. For example, Research and Development are vital for the company to continue to stay relevant, however, to associate this expense with each unit of product doesn’t align as COGS do. We can see the operating expenses for MSFT this quarter were approximately $10.3 billion.

Net Income

When we work through all of these sections and add in taxes we will get to the net income which is the objective of the income statement. That said, as you can see, a lot of useful information can be found within the income statement regarding efficiency and capital use.

One thing that was not mentioned was interest from investments, the reason for this is that it does not represent a core part of the business.

MSFT Quarterly Statement – Sep 2020

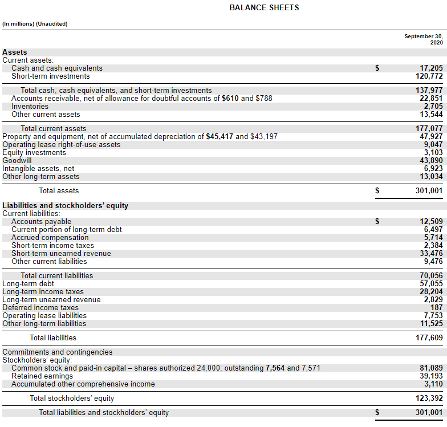

Balance Sheet

Like the income statement from above the balance sheet has sections, two major to be specific. The two major sections are Assets and Liabilities + shareholders equity, these two can further be broken down into current and long-term. Current simply means within one year, i.e. current assets are assets held for one year or less. As a reminder, the balance sheet is a snapshot in time (on a specific date) of the financial standing of a company, and the assets must equal the liabilities + shareholders equity. Here’s a math equation that may help:

FORMULA:

Assets

Shortest duration assets are always listed first, starting with the most liquid. Almost always this will be cash and cash equivalents. From there longer duration assets will be listed which would include property, plant, and equipment (PPE), goodwill, and so on. These types of assets are much harder to buy and sell quickly so their liquidity is much less.

When you reach the bottom of the Assets you’ll come to total assets, as the name implies these will be the long-term assets added to the current assets.

Liabilities

On the liabilities side of the balance sheet, the same format of shortest to longest duration is followed. Starting with current liabilities, these are liabilities that are incurred and cleared within one year. Long-term debt could include bonds that the company has issued. One question that might arise is how can the assets and liabilities balance? Say a company borrows less than the value of the assets it has? The difference between the two represents shareholder equity.

Shareholders Equity

This is the money attributable to shareholders (owners) after the liabilities are subtracted from assets. Below is MSFT’s balance sheet from its Sep 2020 quarterly report, it may help solidify these ideas.

Where to find financial statement information:

Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html . This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements. Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10Q, once you find them navigate to “financial statements”.

Additional resources: Investments ratios