What is Net Present Value?

In short:

Net present value (NPV) is an estimate of what the sum of all future cash flows of a project or investment would be worth if they were received today after subtracting the initial investment. The value of NPV is that it allows companies or investors to estimate the profitability of an investment or project, more plainly, if it will add value or destroy value.

To calculate NPV, the estimated future cash flows must be “discounted” back to their present value, summed together then the initial investment amount is subtracted from them. If the NPV calculation results in a positive value, the project/investment is considered profitable. On the other hand, if the NPV calculation results in a negative value the project/investment should be avoided.

Typically, the discount rate used in the NPV calculation is the company’s weighted average cost of capital WACC, also called the hurdle rate.

Formula:

Key Points

- Net present value (NPV) is an estimate of what the sum of all future cash flows would be worth if they were received today after subtracting the initial investment.

- Projects or investments with a negative NPV should be avoided.

- If projects or investments have a positive NPV they are generally considered profitable.

- NPV accounts for the time value of money by using a discount rate which is often the cost of capital – WACC or hurdle rate.

In-depth:

Present Value & Time Value of Money

Before you can understand “net present value” you must understand present value and the time value of money. Time value of money is the concept that money today is worth more than money tomorrow and is true so long as the “risk-free rate” is positive i.e. US government bonds.

Time value of money

To understand time value of money, consider this scenario. Say we were to offer you two options. Option one, we can give you $100 today that you could go do whatever you wanted with, or option two, we can give you the same $100 but 1 year from now. Which option would you choose?

You would choose option one as would everyone else, why wait 1 year for the same amount of money?

Now say we change the scenario a bit. Now with option one we still offer to give you $100 that you can do with whatever you please. However, in option two, we’ll give you $110 if you wait 1 year. Which would you choose?

With the second scenario, more people would choose option two since they’ll receive $10 additional dollars by simply waiting 1 year. Likely, if you don’t have a need for the cash and nothing available that would earn more than $10 in a year on that $100 you too would wait.

This is the time value of money, that is, money today is worth more than money tomorrow because if you receive the same $1 today as tomorrow, by receiving it today you can make it earn money over that time.

Present value

To account for the time value of money we need to see how much $1 received further out in time would be worth if we received that $1 today. To do this we “discount” the value of that $1 to what it would be worth today, this is called the present value.

Present value simply put is the value of future cash if it were earned today.

If you understand compound interest, that is, seeing what money would be worth if you grew it by an interest rate over time. Then, present value is the reverse of compound interest, what is future money worth is we shrink it over time.

What is Net Present Value & How is it Used

So, what is net present value (NPV)? NPV is an estimate of what the sum of all future cash flows of a project or investment would be worth if they were received today after subtracting the initial investment. That is if we know the cash flows in the future, when in the future they are received, what our capital costs are, and how much we would need to initially invest then we can figure out if we are going to make money or lose money and how much we are going to make or lose.

Both companies and investors need to be able to reasonably know if they will make money on a possible project or investment and not just that but how much money they will make. All well-run companies will know their cost of capital and all investors will know the minimum return they need to achieve on a particular investment.

This allows companies and investors to look at a cost of an investment and its potential cash flows then discount them back to see both if they are making/losing money and how much, i.e. using NPV calculation. This will give them a good idea if they should make the investment or not.

Net Present Value Calculation

To understand how to calculate NPV we can look at an example situation.

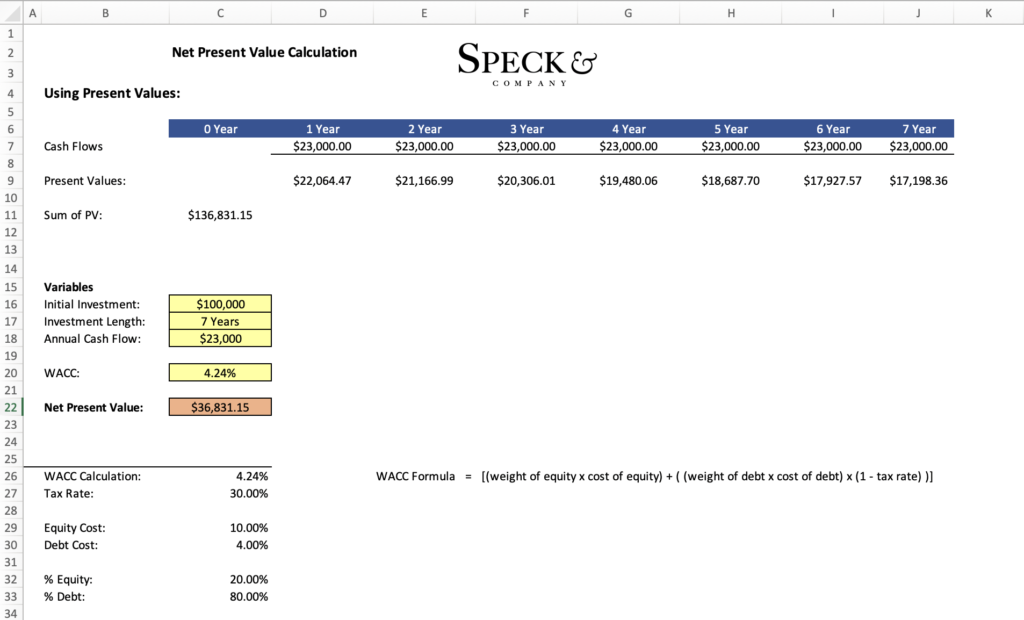

Let’s say we are looking at a personal investment in a plow truck for our snow removal business. The initial cost of the plow truck would cost us $100,000 but we estimate the useful life of the truck would run 7 years and we would be able to consistently generate $23,000 of free cash flow a year. Should we make this investment?

As we think about it, we know that if we put $100,000 in the stock market we can reasonably expect to earn an annualized 10% return. So, if we were paying all cash our hurdle rate (WACC) would be 10%.

At this point, we can plug these values into the illustrated NPV formula from above which would look something like this.

With our current example, the NPV of the plow truck investment is positive meaning we should make the investment in the truck. Phrased differently this means the actual rate of return on the truck is higher than the cost of our capital.

So now that we know our snowplow truck investment has a positive NPV, what happens if we adjust the example above to adjust our WACC. Before, we were using only cash which is likely not what a company would do. A company would also use debt in their WACC calculation which we can do as well.

Let’s extend the example above by financing 80% of our WACC via debt which we pay a 4% interest rate on. If we adjust our WACC for this, the hurdle rate for us to beat becomes 4.24%. In this case, the NPV of the plow truck increases to $36,831.15 or we increased the absolute dollar return of our investment by over 3 times. This serves to illustrate the power of leverage and how changing the WACC will change the NPV.

Please note, adding leverage (debt) will increase the riskiness of an investment or project so while it can increase returns debt does not come without a tradeoff.

Net Present Value vs Internal Rate of Return (IRR)

Internal rate of return (IRR) and NPV are different sides of the same coin. The difference between NPV and IRR is that IRR is the discount rate that will turn the NPV of a project to zero. More simply, IRR is the average compounded annual return of an investment or project whereas NPV is the dollar value return of an investment or project.

For example, in the scenario above where our WACC was 10%, the IRR of that project was 13.55%. This may also make intuitive sense since we determined it was more advantageous to invest in the truck than to invest in the stock market, i.e. the truck has a higher return.

Frequently Asked Questions

You calculate the net present value by discounting the estimated future cash flows back to their present value, then summed together subtracting the initial investment from them.

A good NPV is one that is greater than zero. This means that the project is profitable and will add value to the company. A bad NPV is one that is less than zero, meaning negative. A negative NPV indicates the project or investment will destroy value.

NPV is important to know because it allows companies or investors to estimate the profitability of an investment or project. Without NPV it would be difficult to tell not only if an investment is profitable but how much profit is stood to be made.