In short:

Weighted Average Cost of Capital (WACC) is the blended average cost of all a firm’s sourced capital, or put simply, the average cost to finance its business from both equity and debt.

The calculation for WACC will weigh each source of funding’s cost proportionally to the percentage of total capital it represents.

For a company, the value of WACC is to know their hurdle rate which represents the minimum return a project must generate in order to be considered. For investors, WACC will be an important part of seeing if a company is valued improperly.

Key Points

- WACC is a business’s cost of capital, or more simply, the cost to finance its business from both debt and equity.

- WACC is used by a firm to identify their hurdle rate, that is, the minimum rate of return a project must have in order to be viable.

- The calculation of WACC will always yield an estimated value as it is not realistic to say WACC is exactly a certain value.

- The discount rate in discounted cash flow analysis is often a company’s WACC.

In-depth:

What is WACC?

All companies need capital to fund their operations. Think about it, if you wanted to start a business you need money to buy equipment, pay for a place to operate out of, possibly pay people, etc. When it comes to getting this capital business owners have two possible options to source their capital from.

Option 1, they can pay for everything out of their own pocket and/or get investors to give them money in exchange for some ownership. This type of capital is called equity (ownership) and is almost always the most expensive form of capital.

For large companies, equity can either be common stock or preferred stock. The “cost” is the expected return for the equity, i.e. common or preferred stock.

Option 2, the other possible source of capital is debt. Instead of funding all of the operations out of the owner’s pocket, they can borrow money for the business operations which would be using debt. Debt is almost always the cheaper form of capital up to a certain point but it adds risk to the business.

For large companies, debt can either be banknotes or bonds. The “cost” is the interest rate the company pays on the debt. So where does the weighted average cost of capital (WACC) come in? WACC is used when a combination of both debt and equity is used to source the capital for a company. Since both debt and equity will have a different cost associated with them, we need to have a calculation to figure out how much our capital costs.

WACC Use

Once a company knows its WACC, it can compare the project’s internal rate of return to its WACC to see if the project adds value or destroys value. They can also use WACC in the net present value calculation to determine the absolute dollar value a project may add or destroy.

Additionally, WACC may be used by investors as part of a discounted cash flow analysis of a company to see if the company is valued fairly or not.

*If you wanted to buy a business the same logic applies but instead of paying for equipment you would need to buy out the other investors.

WACC Formula & Calculation

The formula below calculates WACC taking into account preferred stock (a form of equity) which many companies do not have. In the case, a company doesn’t issue preferred stock this part of the equation can be dropped.

WACC Formula:

Looking at the debt section of the equation we will multiply by (1 – Corporate Tax Rate). The reason for this is that the interest on debt is tax-deductible since it is a cost to the business, however, dividends on common and preferred are not.

Before we can calculate WACC via the formula above we need to calculate the cost of equity and the cost of debt. Depending on our use case for WACC we may need a different level of information to calculate each.

Calculating Cost of Equity

The cost of equity represents the opportunity cost for an investor who decides to buy an equity stake in a company. This value is a theoretical value, in that, it is the minimum return investors expect to receive for the risk they take on by owning stock in a company.

Components of the calculation for the cost of equity are of debate and may require more detail depending on the use case of the WACC calculation.

The cost of equity is calculated using the Capital Asset Pricing Model (CAPM) which calculates the expected rate of return for a given amount of risk. We will look at each component of CAPM and what level of detail you may need below.

CAPM Formula:

Cost of Equity = RF Rate + Beta x ERP

Where:

RF Rate = Risk-Free Rate

ERP = Equity Risk Premium

The main difference between the quick and long approaches will be in the beta value.

Risk-Free Rate

The risk-free rate represents the return on investment of an investment that carries zero risk. For companies whose earnings are primarily in dollars, the risk-free rate will be the current interest rate on 10-year U.S. Treasuries.

Equity Risk Premium

Equity risk premium (ERP) is the return above the risk-free rate that an investor can expect to earn by investing in the stock market broadly. There are several ways to calculate ERP all of which are a point of debate. One quick approach is to take the average return of the stock market and subtract the risk-free rate, i.e. ( Market Return – RF Rate).

Another option is to use more detailed calculations from publications like Ibbotson’s or Professor Damodaran’s website.

Beta Quick Approach– not in a valuation

Beta can be the most labor-intensive part of the WACC calculation since it accounts for the riskiness of a business. If you only need a quick approximation for WACC then the beta that can be used is the beta you can get off Bloomberg, Capital IQ, or off a stock website such as google finance or yahoo finance. This beta will be the “levered beta” meaning it includes the normal business risk of the company and the risk that comes from leverage (debt).

Beta Longer Approach- in a valuation

If we are calculating WACC for use in a discounted cash flow analysis to find the implied value of the business we wouldn’t want to just use the levered beta like we did above. This is because we are trying to see if the business is properly valued or not so we need to “adjust” the beta to examine average business risk in their industry type and then to reflect their amount of leverage.

To “adjust” the beta we need to calculate the unlevered betas among comparable companies, get the average unlevered beta of these companies then re-lever this beta to reflect the leverage level of the company we’re looking at.

First, we find comparable companies, i.e. similar size and business type, then we unlever their beta* via this formula:

Unlevered Beta = Levered Beta / (( 1 + ( 1 – Tax Rate ) * (Debt / Equity)

By doing this we are looking at only the risk that comes from being in this kind of business. We take the average of these unlevered betas from multiple companies to find the average business risk.

Second, once we have the average unlevered betas for the business type we need to account for our company’s leverage level. To do this we need to re-lever this average unlevered beta to reflect the debt level of our business.

We re-lever the unlevered beta via this formula:

Levered Beta = Unlevered Beta * (( 1+ ( 1 – Tax Rate) * (Debt/ Equity)

At this point, we’ve “adjusted” the beta to reflect if the company is improperly valued in our discounted cash flow analysis. This would be the beta we want to use in our CAPM calculation of the cost of equity for WACC.

*You take the levered beta as we did above from Bloomberg or Yahoo Finance then unlever.

Calculating Cost of Debt

Like calculating the cost of equity, calculating the cost of debt comes with different approaches and different levels of detail attached. Here, however, generally, either approach will be reasonably close enough unless told otherwise.

Quick Approach– not as accurate

The quickest approach is to find the average yield on the book value of outstanding debt. This will reflect what the company is paying on the debt they’ve issued. That is, this is a lagging indicator of their cost of debt. If they were to issue debt today they would likely have to pay a different amount from changes in their credit or the interest rate environment.

Longer Approach- more accurate

The longer more accurate approach to finding the cost of debt is to calculate the yield to maturity on the company’s debt. The difficulty here could be that it may be hard to identify the current market value of their debt in which case you would want to use the approach above instead.

WACC Example Calculation

To truly understand the WACC calculation we can look at an example.

Let’s say we are looking at company whose capital structure is 70% debt, 30% equity, and pays a corporate tax rate of 25%. The company’s stock has appreciated at an annual rate of 11% for the last several years and they’re paying 3.5% on their debt. Additionally, we know this company doesn’t have preferred stock.

If we apply the WACC formula from above our calculation would be as follows.

[ 30% * 11% ] + [ 70% * 3.5% * (1 – .25) ] = 5.14%

One way to interpret this is that for every $100 of capital the company must pay $5.14 per year for the capital or any project they take on must make more than $5.14 per $100 it uses.

Calculating WACC in Excel

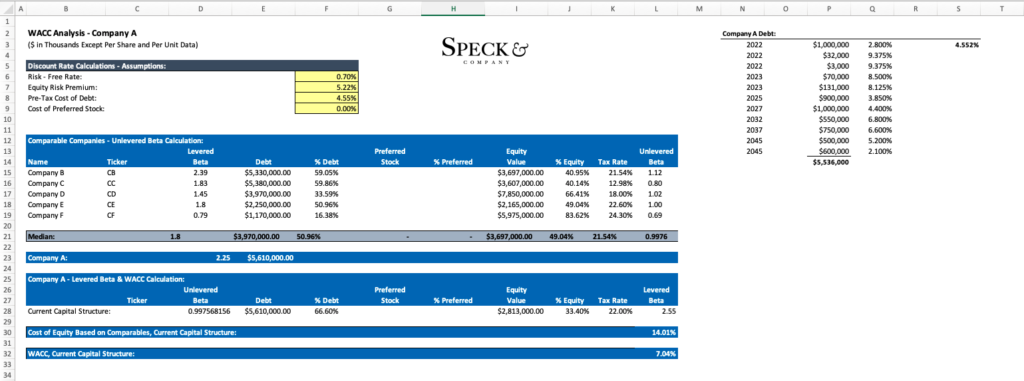

We cover how to calculate WACC in excel with much greater detail in our article on How to Calculate WACC in Excel. However, we have attached an illustrative image of the general approach, this image should also illustrate the points we made when covering CAPM and the cost of equity.

Frequently Asked Questions

WACC represents the cost of capital for a company. When WACC is high, this means the company must pay more for its capital and is likely a result of higher risk. Conversely, when WACC is low, this means the company can pay less for its capital which is likely a result of lower risk.

WACC is the weighted average cost of capital and is important because it describes the minimum amount a company must generate on its capital. WACC is used by companies to determine if an investment adds value to the company or destroys value.

Weighted Average Cost of Capital (WACC) is the blended average cost of all a firm’s sourced capital, or put simply, the average cost to finance its business from both equity and debt. WACC is calculated with this formula: WAC = [ % Equity x Cost of Equity ] + [ % Preferred x Cost of Preferred ] + [ % Debt x Cost of Debt x (1 – Tax Rate) ].