The right but not the obligation

In short:

A stock option represents the right but not the obligation to buy or sell a stock at a predetermined price within a predetermined timeframe.

There are two types of stock options: calls, which is a bet that the stock price will rise, and puts, which is a bet that the stock price will fall. The seller of the option is called the option writer.

Key Points

- Options represent the right but not the obligation to buy or sell a stock at an agreed-upon price within an agreed-upon time.

- There are two types of options: calls and puts.

- The seller of the option is called the option writer and is “short” the option.

- Standard stock option contracts consist of 100 shares of stock.

In-depth:

Understanding Stock Options

A stock option is a contract between two parties over the right to buy or sell a set number of shares at a set price within a set period of time. This type of contract is a financial instrument known as a derivative – where the worth of a financial instrument is derived from the value of another underlying asset.

For a stock option to have immediate value, the option must be in the money. In the money means that the current price of the underlying shares are trading above the strike price for a call option or below the strike price for a put option. In the money options have intrinsic value, which comes from the difference between the current price and the strike price.

If the underlying share’s current price is trading below the strike price for a call option or above the strike price for a put option, the option is out of the money. The only value out of the money options have is opportunity value, called extrinsic value, which is a function of time, volatility, changes in the price of the shares, etc.

Real World Example

At first glance, options can seem confusing, however, when you apply the concept of options to things in everyday life it starts to get clearer.

For instance, consider applying the idea of options to buying a house. Say we are in the market to buy a house. We’ve looked at quite a few different houses before we come across a house that we are interested in at our price point of $250,000, but it’s not quite perfect and we’d like to keep looking.

The problem though is that If we pass on the house altogether, we may lose the ability to come back and buy the house for $250,000 -housing prices may go up. So, we ask the seller of the house if they will give us an “option” to buy the house at the current price.

The details of the option we are asking for are as follows. We will pay the seller $3,500 to the right to buy the house for $250,000 at any point in time over the next 30 days. If we do not tell the seller that we want to buy the house within those 30 days, the option expires, and they are free to sell the house to anyone else at any price they like.

Additionally, the seller of the house will get to keep the $3,500 regardless of if we buy the house or not.

Thankfully the seller agrees and gives us this option. Over the next 25 days, we go out and keep looking for other houses but cannot find anything we like. On top of that, the housing market makes a big move higher in price. Similar houses to the one we have an option on are now selling for $300,000.

Since we still have 5 days left to go on our option we come back to the seller of the house and tell them we would like to buy the house. The seller isn’t exactly happy that they have to sell us the house at $250,000 when now they could sell the house for $300,000 but since they sold us the option, they must sell us the house for $250,000.

Stock Option Types

There are two types of stock options:

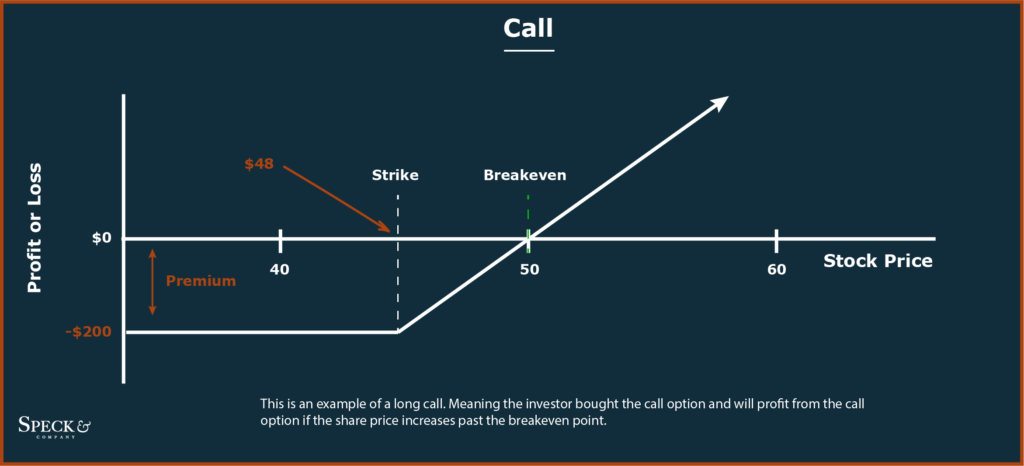

- Stock call options, which is where the option buyer has the right but not the obligation to buy the underlying stock at the strike price within the agreed-upon timeframe. The seller, or option writer, profits from the premium if the option expires worthless.

- Call options gain in value when share price rises.

- Stock put options, which is where the option buyer has the right but not the obligation to short sell the stock at the strike price within the agreed-upon timeframe. The seller, or option writer, profits from the premium if the option expires worthless.

- Put options gain in value when share price decreases.

Strike Price

The strike price is the agreed-upon trade price by the option buyer and option seller.

For example, in a call option with a strike price of $150, $150/share is what the option buyer will pay the seller for the shares if the option is exercised. This means if the shares are trading at $170 the option buyer has the right to buy the shares from the option seller for only $150/share.

Likewise, in a put option with a strike price of $100, $100/share is the price the option seller must buy the shares for from the put option buyer if the option is exercised. This means if the shares are currently trading at $80, the put option buyer can sell the share for $100 when they are only worth $80.

Premiums

An option premium is what is paid to the seller of the option as compensation. To calculate the total option premium, multiply the premium quoted price by the number of underlying shares (typically 100 shares in a standard contract).

For example, if a standard option contract is quoted as $1.35, this means ($1.35 x 100 = $135) $135/contract. The $135 is the price the option buyer will pay and the amount the option seller will receive.

Settlement & Expiration Date

Settlement is the process of transferring the underlying asset as defined by the option. This happens only when an option is exercised. Depending on the option, settlement may take place as a cash settlement instead of an exchange of assets (shares of stock).

Expiration date represents the day the options rights end and are no longer valid. Depending on the option style, rules for when and how settlement take place may differ. In the modern market, there are two option styles:

- American-style options where the option holder can exercise the option at any time before expiration.

- European-style options where the option holder can only exercise the option on the day of expiration.

The majority of options are American-style options.

Contracts – Packaging Stocks Together

Contracts represent the package of shares tied to an option. The standard contract contains 100 shares, however, contracts can contain other numbers of shares.

In other words, buying 1 options contract does not mean you are buying an option on 1 share of stock. Instead, you are buying an option on 100 shares.

Stock Option Example

Say you were interested in buying Microsoft (MSFT) 287.50 October 1 2021 calls. The current premium is quoted at $1.60 meaning the total premium for 1 standard contract is $160. Additionally, the current price for MSFT is $286.90 with 2 days remaining until expiration.

Does buying this call option make money?

Fast-forward to expiration, MSFT is now trading at $287.75 meaning the option is in the money. If the buyer exercises the option ($287.75 – $287.5)*100 – $160 = -$135.

No, the call buyer did not make money.