The annual cost to the investor

In short:

A mutual fund expense ratio is the amount of money the fund management annually charges its investors to manage and operate the fund. The ratio is expressed as a percentage of investments or, another way to put it is, the amount they charge for every dollar invested. Typically, the expense ratio for a mutual fund can be anywhere between .1% to 2.5% but varies depending on the type of mutual fund, its objectives, and what underlying investments the fund is making.

The expense ratio includes paying for lawyers to keep up with regulations, accountants to calculate the fund’s net asset value (NAV), the fund manager who manages the holdings of the fund, and analysts who assist the fund manager. Trading fees are not included in the expense ratio which is more important for actively managed funds than for passively managed mutual funds.

Key Points

- The mutual fund expense ratio is the management fee and operating expense of the fund.

- Expense ratios are expressed as a percentage.

- Trading fees are not included.

- Expense ratios are in addition to any load charged by the fund.

In-depth:

What you get when buying a mutual fund

When someone invests in a mutual fund, they are investing in a company that pools money together from many investors in order to implement an investment strategy which could include buying stocks, bonds, or other assets. Mutual funds give investors access to professional money managers who allocate the funds money on behalf of their investors, often giving investors access to better diversification (reduced risk) than they could have on their own.

Essentially, mutual funds allow investors to bet on a group of companies by buying into the fund instead of having to go out and buy all those companies individually. This, therefore, saves them time, money, and gives them access to a full-time professional.

Like all companies, there are operating expenses that must be covered in order to pay employees and stay in business. Mutual funds cover these expenses by charging the assets of the fund which gets passed on to the investors and is expressed as the expense ratio.

How the expense ratio affects investments

Any charge against an investment effectively reduces the amount of money available to go to work for the investor, this is called a drag on the investment. The greater the charge the greater drag is being placed on the investment. Expense ratios, while paying for a valuable service for many investors, are no exception to placing a drag on investments. Here’s how it works.

Let’s say an investor wants to invest $10,000 and is currently looking at a mutual fund with a high expense ratio of 2%. This means that if the mutual fund was able to grow by 10% the first year the investor’s investment would be $11,000 at the end of the year before factoring in the expense ratio. Now if we factor in the expense ratio of 2% the investor’s investment is $10,780.

While $220 may not seem like a big amount the drag becomes clear when extending our example over 20 years. Assuming the same $10,000 investment was able to average a 10% return over 20 years the total drag impact is over $20,000 or twice the initial investment.

What’s a good mutual fund expense ratio?

The purpose of the example above is not to discourage anyone from investing in mutual funds, rather to draw attention to the impact the fees they are paying may have. The important thing is to make sure the fees line up with the value the investor is getting from the mutual fund. Paying a little more for a mutual fund that consistently outperforms the market can certainly be reasonable. On the other hand, if the fund is only performing in line with the average, why pay more than the average?

A good mutual fund expense ratio is very dependent on the returns of the fund. Generally, most mutual funds should have an expense ratio under 1% in order to be considered worthy of consideration. Many high-quality index funds such as ETFs that track the S&P 500 or Nasdaq 100 charge under .5%. This is because they are passively managed to require less overhead. Most actively managed equity or hybrid mutual funds will have an expense ratio somewhere between .5% and 1%.

Where to find mutual fund expense ratio information?

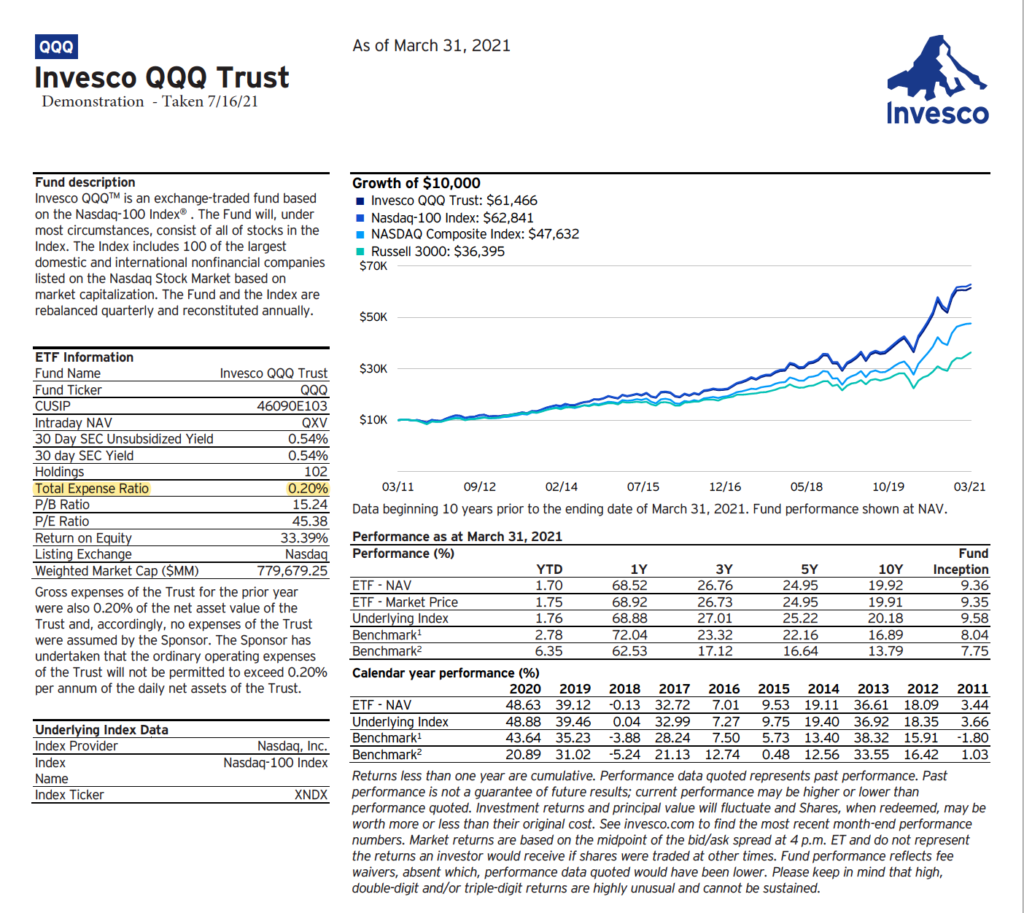

There are a few places you can look to find expense ratio information when researching mutual funds. The first would be to look up the fund’s expense ratio directly on the fund’s website. For example, say you wanted to look up the expense ratio on Invesco QQQ Trust (QQQ) you could simply navigate to Invesco’s website, look up the ticker “QQQ” then look for “Total Expense Ratio” within the Fact Sheet.

The second way to find expense ratio information is to look up the mutual fund on a stock data site such as Yahoo Finance or Google Finance. In this case, you could be interested in SPDR S&P 500 ETF Trust (SPY). Looking up the ticker “SPY” then navigating to “Expense Ratio” will get you the information.

Finally, mutual funds must put out detailed information about the fund in something called a prospectus. Within the prospectus will be tons of detailed information about the fund including its expense ratio.