Owning the underlying asset and selling a call option on that asset

In short:

A covered call is a use of options whereby an investor sells (writes) a call option on an equivalent amount of the underlying asset they already own. If the call option ends up in the money and is executed, the investor can deliver the underlying asset to the call option buyer and isn’t at risk of needing to go out and buy the underlying asset.

The advantage of a covered call is that it allows an investor to generate additional income on the underlying asset they already own.

Key Points

- A covered call is an options strategy that requires owning the underlying asset to sell a call option for an equivalent amount of the underlying asset.

- For a covered call to be profitable, the underlying asset must have neutral price movement meaning it cannot appreciate or depreciate quickly.

- Typically this strategy is employed by an investor who intends to hold the underlying asset for a long time.

- The risk level for writing a covered call is substantially lower than writing a naked call or naked put.

In-depth:

Understanding a Covered Call

Let’s say that you own 100 shares of your favorite stock, however, you don’t believe the stock is going to make any impressive move higher. At this point, you have a few options. You could ride it out, owning the shares as they trend sideways until hopefully, at some point in the future, they trend higher. If you elect to simply ride along as the stock trends sideways you won’t generate any gains.

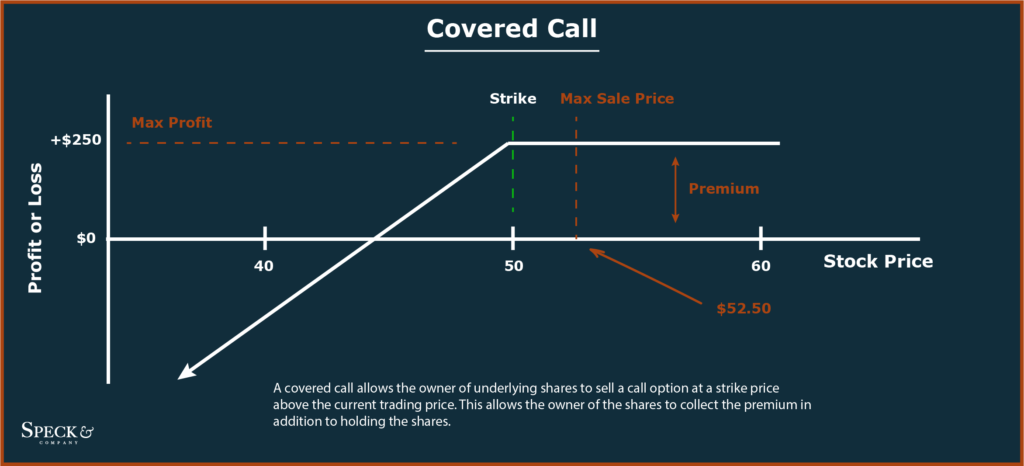

The other option is to sell covered calls. Call options give the option buyer the right but not the obligation to buy the underlying shares for a set price (strike price) within a set period of time. Since you already own the underlying shares the call option is covered by those shares that you already own in the event the call is exercised. In exchange for selling the call, you collect a premium giving you income you wouldn’t otherwise have just for owning the shares.

Unless the price of the stock rises to and above the strike price, the call option will not be exercised and expire worthless.

Key ideas, covered calls require you to own the underlying shares and believe the stock will continue to trend sideways.

The downside, or risk, of a covered call is if the underlying stock moves sharply higher. A sharp move higher would likely lead to the stock price rising above the strike price resulting in the call being executed. If this were to occur, the investor writing the covered call would lose out on some of the upside of the underlying shares.

Additionally, if the investor wanted to own the shares over the long term, they would need to go out and buy back the shares at a higher price.

Maximum Profit with a Covered Call

So, you profit from the premium you receive for selling the call option, but what’s the maximum profit?

Theoretically, the maximum profit you can receive from a covered call is the total value of the premium you received in addition to the underlying shares being only slightly out of the money. This way you lose no money on the value of your long stock position and benefit from the full impact of the option premium.

Example Covered Call

Say we owned 100 shares of Walmart (WMT) stock and wanted to use a covered call to generate additional income.

To create a covered call with our WMT stock we would need to know if we thought the stock is going to trend sideways, what its current price is, and at what strike price we want to sell a call option.

Let’s assume the current share price for WMT is $139.20 and we believe WMT’s shares will trend sideways at least for the next three weeks.

Looking at the options chain for WMT we see the 141 October 22 2021 calls trading for a $1.05 premium. If we decide to write this call option, we will collect $105 in income from the premium and now have ourselves a covered call.

Does this covered call make money?

To answer this, we must fast-forward to expiration. If at expiration WMT stock is trading at $140 then yes, our profit would be as follows:

( market gain up to the strike price ) * # Underlying assets + Option premium = Profit/Loss

( $140 – $139.20 ) * 100 + $105 = $185

Riskiness and Profitability of a Covered Call

The riskiness of a covered call comes from selling, for a short time, the upside potential of the underlying asset. Since the writer of a covered call already has a long position in the underlying asset, any downside from a loss in value of the underlying asset is not a result of selling the call option.

Frequently Asked Questions

The point of a covered call is to generate additional income for an investor who already owns a long position in a certain stock. A covered call is considered low risk for the investor since they already own the underlying stock and therefore would not need to go out and buy the shares if the option were to be exercised.

Covered calls are not free money. The cash received for a covered call is compensation for the upside potential of the underlying stock. If the option is exercised, the covered call writer loses out on the upside of the stock. This means covered calls are typically written for stocks that don’t appreciate greatly and therefore the covered call is a substitution for that appreciation.

A covered call is neither bullish nor bearish. Instead, a covered call is neutral as it will only be profitable for the writer if the underlying stock price does not increase or decrease dramatically.