The right to buy but not the obligation

In short:

A call option is a financial instrument that provides the buyer the right but not the obligation to buy an underlying asset at a set price within a certain timeframe. In financial markets, typical underlying assets are stocks, bonds, and commodities.

Essentially, buying a call option is betting that the stock, bond, or commodities price will increase. Conversely, selling a call option, called writing an option, is a bet that the stock, bond, or commodities price will not increase.

Key Points

- A call option provides the option owner the right but not the obligation to buy a predetermined amount of the underlying assets at a predetermined price within a set timeframe.

- Buying a call option is betting the price of the underlying asset will increase.

- In exchange for the option, buyers must pay the option seller a premium.

- Call options can be used to generate additional income, work in and out of a stock position, speculation, hedging, or for other strategies.

In-depth:

Understanding Call Options

So, how exactly do call options work?

Say we are looking at a call option whose underlying asset is stock. A standard call option contract for stocks consists of 100 shares. Therefore, buying a call option contract on a specific stock gives the buyer of the option the right but not the obligation to buy 100 shares of the stock at the price and within the time specified by the option contract.

The price the buyer of the option has the right to buy the shares at is called the strike price. The day the options contract ends is called the expiration date.

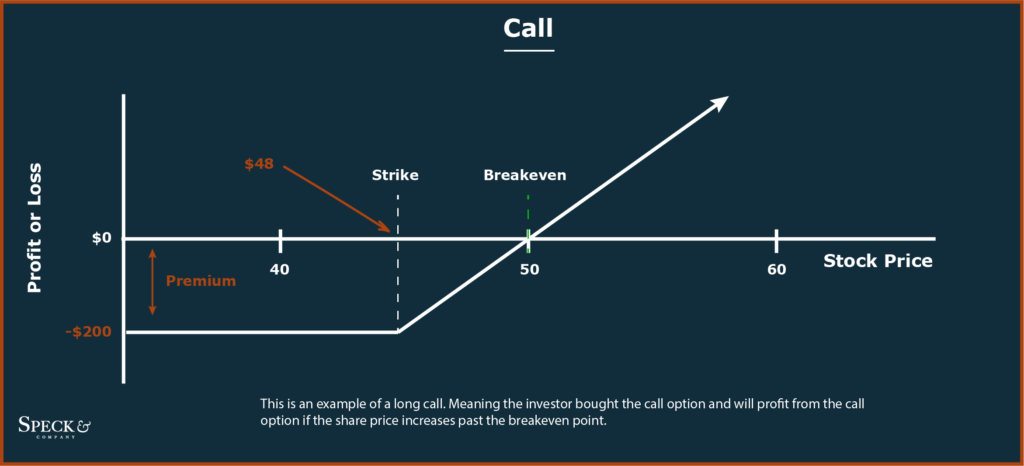

In exchange for selling the right to buy the shares, the option seller collects a fee called the option premium. This is the price the buyer must pay for the call contract and is the maximum amount the call buyer can lose. In this sense, call option buyers have defined risk.

For a call option buyer to profit, the price of the stock must increase in value above the strike price plus the cost of the premium. For example, say an investor bought a Microsoft MSFT call with a strike price of $250 and with a premium of $1.75. In order for the call buyer to profit, MSFT stock must rise not to $250 but above $251.75 in order to cover the cost of the option premium. This is assuming the stock price increases before the options expiration date.

Uses of Call Options

Call options can be used for a wide variety of investing, trading, or speculating activities. Depending on the objectives of the investor, different strategies may be used.

Call Options for Income

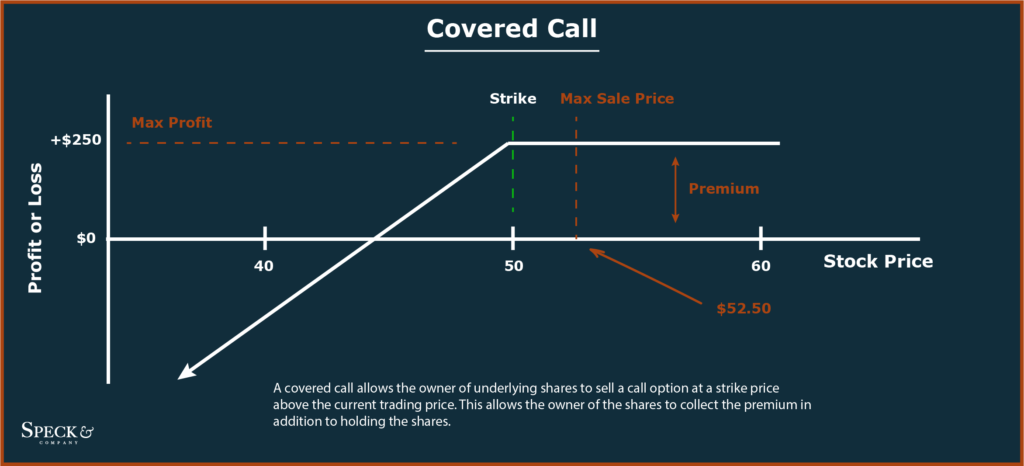

Some investors prefer to use call options to generate additional income to boost the returns of investments they already have. One of the most straightforward strategies to do this is to use covered calls.

A covered call is where an investor already owns the shares of stock they are selling call options on. By selling a call option on shares they already own the investor can collect additional income on the shares in the form of the option premium.

Since the investor already owns the shares, they have no risk of a margin call in the event the call option is exercised.

This use of call options is most suited for stocks or assets whose price is trending sideways or lower as the call is unlikely to be exercised.

Call Options for Working Into or Out of a Position

Some more advanced investors may use call options to work into or out of a position. By using options, they may be able to get in or get out at a better price than they would with a traditional purchase or sale.

Getting out example, an investor looking to get out of a stock position may elect to sell a call option for shares they already own. They will select a call option with a strike price slightly above the current price. If the share price rises to the strike price the call will be exercised, they will be out of their position at the strike price plus the premium from selling the call.

Getting in example, an investor looking to get into a stock position may choose to buy a call option on an upward trending stock instead of buying the stock outright. For this to be an advantageous entry, the stock’s price must continue to trend higher and above the strike plus the premium before expiration.

Call Options for Hedging

A large function of options is for hedging purposes, that is, reducing the risk of loss from market movement. Call options can provide upside protection for call option buyers.

For example, say a hedge fund decided to short GameStop stock but wanted to protect themselves from a possible short squeeze situation. The hedge fund could buy call options on GameStop stock with a strike price at the price they would want to buy back shares at. Since they own call options, if the stock skyrockets higher, the hedge funds loss is limited to the difference between the price they sold the shares at and the strike price of the call plus the premium.

Call Options for Speculation

There are two basic ways to use call options for speculation.

The first and most straightforward way is to buy call options on stocks with no intention of establishing a position in the stock. In this light, the call buyer is solely trying to make a profit from the price movement of the shares with the added benefit of leverage options provide. That is, the call buyer can possibly control many shares at a fraction of their value, the premium.

The second and a bit more complicated approach is an attempt to profit from the change in premium price that comes as a result of the change in the price of the shares. This is more complicated as it can be more volatile and is subject to time decay. That is, as time progresses they lose value since there is less and less time for the option to turn profitable before expiration.

Long Call Example

Say you were interested in buying Microsoft (MSFT) 287.50 October 1 2021 calls. The current premium is quoted at $1.60 meaning the total premium for 1 standard contract is $160. Additionally, the current price for MSFT is $286.90 with 2 days remaining until expiration.

Does buying this call option make money?

Fast-forward to expiration, MSFT is now trading at $287.75 meaning the option is in the money. If the buyer exercises the option ($287.75 – $287.5)*100 – $160 = -$135.

No, the call buyer did not make money.

Is Buying a Call Bullish or Bearish?

Buying a call option would indicate that you’re bullish as the only way to profit from buying a call option comes from an increase in share price. On the other hand, selling call options indicates you are bearish on the nearer-term future outlook as the main way to profit from this strategy is with a decrease in share prices.

Frequently Asked Questions

How a call option works. Call options give the buyer the right but not the obligation to buy shares of stock at a certain price within a certain timeframe. If the shares price increases above the strike price the option owner makes a profit. If the share price doesn’t increase, the option owner’s maximum loss is the call option premium.

A $1 call option. Typically, the strike price of an option is stated in front of the option. For example, a 250 call means the call’s strike price is $250/share.

The maximum loss for a call option buyer is the amount of the premium. Call option buyers have defined risk. However, the maximum loss for a call option seller is theoretically unlimited. This is because there is no defined limit to how high the stock price can rise. Call sellers have undefined risk.