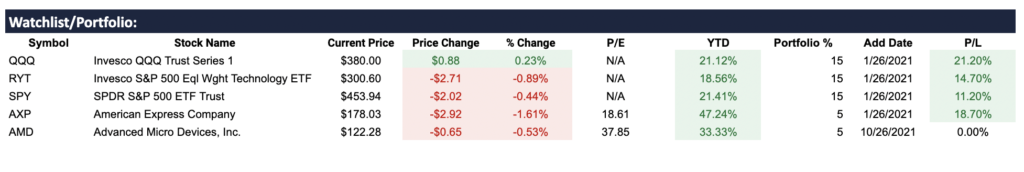

Here’s the weekly rundown

Weekly Summary:

New highs, new highs, new highs!! ?

That’s the only way to describe the incredible climb of just about everything in the market this week excluding Snap, the S&P climbing 1.64%, the Dow 1.08%, and the Nasdaq 1.29% heck Bitcoin even hit an all-time high above $66,000.

So, where’s all the excitement coming from? Wasn’t it just a month ago we were fretting about inflation, supply shortages, and where the heck did all the workers go?

Yep, that’s exactly what was causing all of the market pain in September and for the most part, none of that has been resolved. Yet last week’s earnings from the major banks pointed out that consumer demand isn’t fading as we saw with higher spending on travel, leisure, and entertainment in combination with higher bank balances.

Those earnings propelled us into this week with some upward momentum as more earnings from other major companies would either stall us out or move us a bit higher. Add in the excitement of the first-ever Bitcoin ETF launched on Tuesday (which was the fastest ever to reach $1 billion AUM) and you have the conditions set up for a continued rally -which is exactly how this week turned out.

Excitement of the first-ever Bitcoin ETF caused a mid-week rally in the cryptocurrency’s price to over $66,000 though it would end the week down $1,000 to around $60,500. And for the most part, earnings were on target or beats across the board as September’s worries haven’t yet stalled earnings growth.

Add positive news and excitement together and that’s the driver of the market this week.

***

✏️ On a side note, if you were taking notes on the market you may want to pay close attention to Procter & Gamble’s earnings call (Consumer Staples). In their call, they made a point to mention increased commodity prices and transportation are going to pose a significant headwind to their bottom line. While they’ll likely maintain good organic growth the increase in raw cost will have a tangible impact that they’re going to try to pass on to consumers in increased prices.

Additionally, look at the news on Zillow suspending their home flipping operation. Home demand is very strong yet the inability to quickly turn houses around has totally shut down one of their business segments.

These conditions will likely present increased earnings challenges in the first half of 2022.

The Major Headlines:

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”4″ ihc_mb_template=”1″]

China’s GDP Needs More Energy

? More coal..is what leadership in China is calling for after China’s Q3 gross domestic product (GDP) came in at a weak 4.9%. China’s National Bureau of Labor Statistics cited power shortages as a leading cause of lower-than-expected GDP growth. This comes as many factories had to halt production in late September when coal prices skyrocketed leading local authorities to cut power.

Surging coal prices are just one more difficulty China’s economy has faced this year. Xi’s crackdown in tech and the central government’s efforts to rein in real estate debt are the others. –See Article

Zillow Auto home flips hits snag

?♂️Unfilled hardhats, that’s the problem Zillow cited for suspending its massive house flipping operation on Monday. The company started buying, renovating, and selling houses three years ago attempting to capitalize on its end-user platform to drive resales. While flipping houses in a directional real estate market are often very profitable, Zillow is finding itself with a backlog of houses and not enough boots on the ground to get the houses turned around. The announcement triggered a 10% selloff of Zillow (ZG) shares which recovered by Friday. –See Article

First Bitcoin ETF – Futures

? Want to bet on crypto yet? Someone must as ProShares Bitcoin Strategy ETF (BITO), the first crypto-linked exchange-traded fund, became the fastest ETF to reach $1 billion of assets under management (AUM). For context, BITO which trades Bitcoin futures contracts started trading on Tuesday, by Friday the fund had over $1 billion in AUM and was nearing the maximum futures contracts it can own.

BITO was down roughly 10% on the week, Bitcoin the cryptocurrency was slightly down for the week at $60,517. –See Article

PayPal Is Courting Pinterest

? Picture this, your favorite idea generation social media platform could be getting one step closer to your next shopping site. Info came out Wednesday that payment giant PayPal (PYPL) is in talks to buy Pinterest (PINS) for $70/share or around $45 billion. While the deal is still in the air, we’ll likely know if there’s going to be a deal by Nov. 8 when PayPal reports its quarterly earnings.

Pinterest shares were up roughly 10% and PayPal shares were down roughly 10% this week. –See Article

Donald Trump, A SPAC, and GameStop..

? Weird combination, right? Reality can be weird because that’s the best way to summarize how Donald Trump’s Twitter-like platform Truth Social ended up trading after being bought by special purpose acquisition company DWAC. Before announcing the acquisition, shares of DWAC were trading around $10 Thursday, as of the close Friday shares of DWAC were $94.20 or a $2.9 billion valuation. –See Article

A Few Earnings From This Week

- Procter & Gamble

Earnings Beat $1.61 vs $1.59 est

Higher top-end rev. and organic growth in line with their initial estimates but took a bottom line hit from higher input costs (freight and commodity costs). Bottom line earnings down 1%, expect to see significant pressure on earnings going forward from freight and commodity costs. Plan to raise prices to help offset inflation.

- Johnson & Johnson

Earnings Beat $2.60 vs $2.35 est

J&J makes $500 million in Q3 from COVID 19 Vaccine.

- Netflix

Earnings Beat $3.19 vs $2.56 est

Squid Game’s success shows Netflix isn’t going anywhere adding 4.4 million subscribers in Q3 vs a 3.84 million estimate. This comes as Netflix begins rolling out large amounts of delayed content. Looking forward, Netflix plans to add 8.5 million subscribers in Q4

- American Express

Earnings Beat $2.27 vs $1.75 est

American Express is capturing the hearts of younger credit cardholders. Additionally, spending on cards surpassed pre-pandemic levels pushing revenues in Q3 to $10.9 billion 25% higher than last year. Consumer spending on goods and services was 19% higher in Q3 than Q3 2019. American Express eps represents an earnings beat of 29%.

[/ihc-hide-content]

Want this in your inbox? Get it for free