The Cash Flow Statement

In short:

The cash flow statement is a financial statement that shows the actual cash-generating power of a company over a period of time. While the income statement uses non-cash items to figure net income, the cash flow statement adjusts out these non-cash items and also adds cash inflows/outflows that may not appear on the income statement. As a result, the cash flow statement is often looked at as a connecting statement between the income statement and the balance sheet.

With the ability to show the actual cash-generating power of a company, the cash flow statement is a major place of investigation for investors and generally the most important financial statement. The cash flow statement is also the most intuitive with only three main sections, they are cash flow from operations, cash flow from investing, and cash flow from financing.

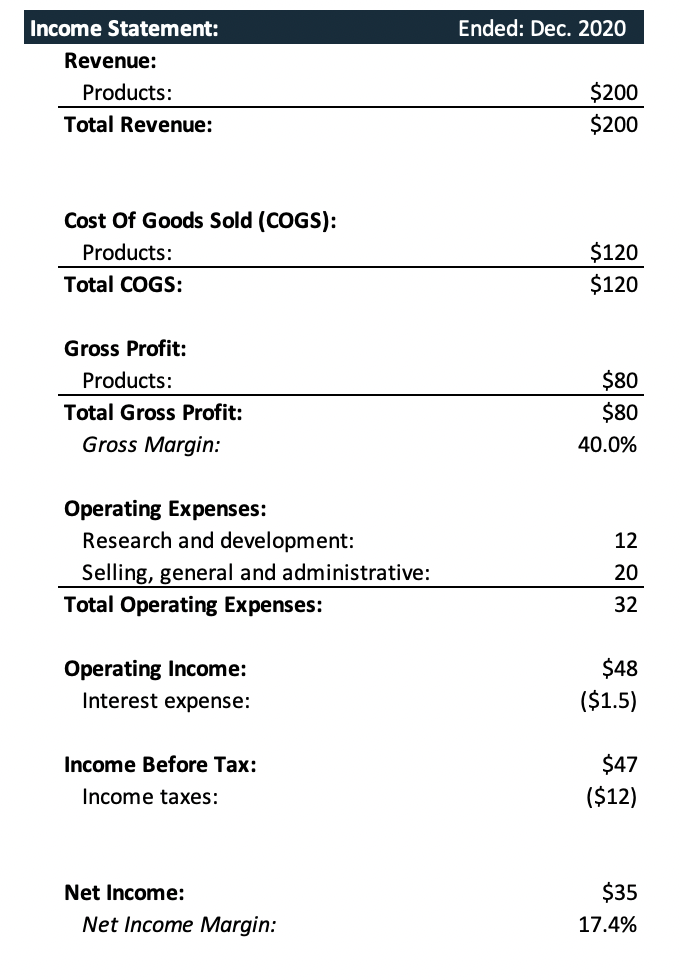

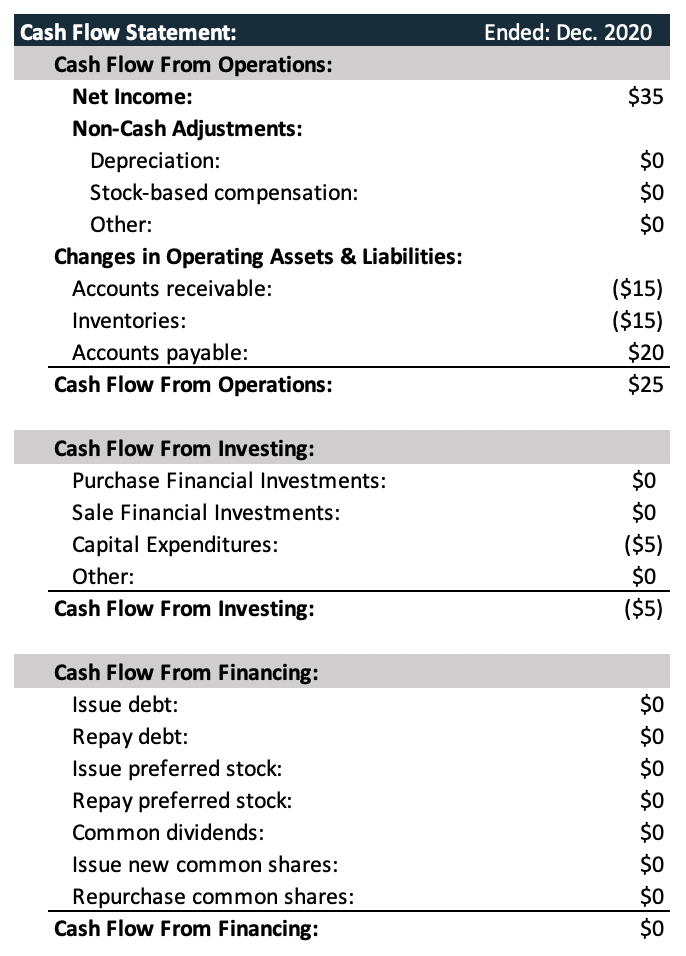

Basic Cash Flow Statement Example

In-depth:

The cash flow statement helps reconcile timing differences between accounting for income/expenses and actually receiving income/expenses. Since income/expenses are recorded on the income statement based on delivery and not actual payment what a company reports on its income statement may not be the actual cash it generated. For example, a company may deliver a product and be waiting to receive payment. In this case, they would record a non-cash increase in revenue on the income statement which would later be subtracted out on the cash flow statement. Since the company has not received payment for this product the cash is not available to them.

Not all items on the cash flow statement are exactly due to timing differences. Some non-cash items added back from the income statement are a result of lowering the tax bill a company pays. Depreciation is a good example. A company will use depreciation on assets it owns in order to reduce its tax bill. In reality, this is not a real cash expense because the company isn’t forking out money. Instead, this is the governments’ way of recognizing annual usage of an asset has a cost (eventually the company will need to replace the asset). Since this is not a real cash cost, depreciation will be added back on the cash flow statement leading to more cash available to the company.

There are also items on the cash flow statement that do not directly appear on the income statement, for example, capital expenditures (CAPEX). This is a major required item for companies and often a major source of cash outflow. However, this will flow back via depreciation on the income statement in future time periods.

Ultimately, the cash flow statement allows for a deeper look at a company’s cash-generating ability than the income statement although they are strongly connected. Net income which is the final line on the income statement is the first line of the cash flow statement (indirect method). From this point, non-cash expenses that were listed on the income statement will be added back while non-cash income will be subtracted away.

Cash Flow from Operations

This is the first section of the cash flow statement. This section represents all the cash flows from core business activities. The first line item is net income which is taken from the bottom of the income statement. From there non-cash expenses such as depreciation and amortization are added back while non-cash revenue is subtracted out such as accounts receivable.

Cash Flow from Investing

The second section of the cash flow statement is cash flow from investing. In this section items such as capital expenditures (could be listed as property, plant, and equipment), financial investments, or other investing activities will be listed.

Something that should be noted would be that often CAPEX is a large or increasing number. This should be taken as a bad thing at face value. Often times growing healthy companies have increasing CAPEX because they are spending more on more mainline business items that will increase revenue. On the contrary, businesses that have decreasing CAPEX could be a sign that the company is struggling. Either way, deeper investigation by an investor should help answer this question for a specific company.

Cash Flow from Financing

The final section of the cash flow statement is cash flow from financing. This section list the items related to where the company gets its funding for its business operations, these items could be debt, stock issued, dividends, etc.

Companies need financing for many reasons, a company may be starting, expanding, renovating, etc. This section lets an investor see where the money to fund a company comes from. Is the company getting more money from lenders or from equity investors? Is the company paying its equity investors (dividends, stock buybacks)?

Free Cash Flow

Free cash flow, the main point where a company gets its value. As we saw a little bit above, net income does not represent the true net cash income a company makes over a period of time, to get this value we look at free cash flow.

Finding free cash flow is not as easy as net income. There is no bottom-line item in the cash flow statement saying “free cash flow” and taking “net change in cash” is definitely not correct. Rather, this value must be calculated by taking cash flow from operations and subtracting out capital expenditures which will likely get you close to free cash flow. Generally, you can get close to free cash flow by using the formula below.

FORMULA:

Free Cash Flow = Cash Flow from Operations – Capex

Where to find financial statement information

Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html. This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10-Q, once you find them navigate to “financial statements”.