What is a Balance Sheet?

In short:

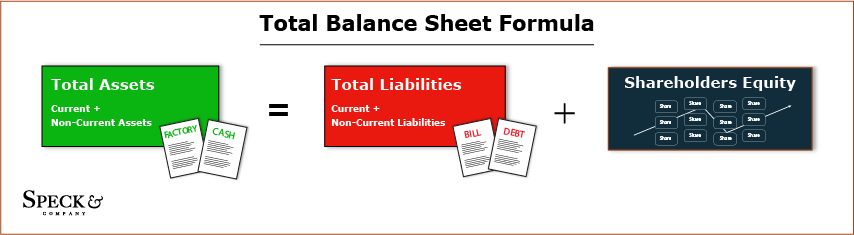

A Balance sheet is a financial statement which states the overall financial standing of a business at a certain point in time. The balance sheet does this by listing the assets, liabilities, and shareholder’s equity following the fundamental rule assets = liabilities + shareholder’s equity. The balance sheet along with the other core financial statements (Income statement and Cash Flow statement) are a major point of investigation for investors, from these statements financial ratios and fundamental analysis are done.

FORMULA:

In-depth:

The balance sheet has three main sections with each being able to be broken up into more detail. Each section begins with the most liquid/shortest duration and moves down to the most illiquid/longest duration. Short duration/liquid are call current while long duration/illiquid are called long-term. To determine whether something is current the timeframe can be considered, if the duration is less than one year the item would be current.

Assets

Assets are what the company owns, they provide value to the company and help them generate revenue. On the balance sheet, the assets will be listed from shortest duration to longest. If items fall within the “current” category that means they can be converted to cash in less than one year. Conversely, if items fall into long-term they cannot be converted into cash within a year.

Liabilities

Liabilities are what the company owes, they are one way a company can seek funding for their operations, investments, etc. On the balance sheet, they are listed again from shortest duration to longest, using current to denote short term and non-current for long term.

Many people think liabilities (more specifically debt) are a negative, however, most companies operate at more optimal levels with reasonable amounts of liabilities. The reason for this is the cost associated with liabilities (more specifically debt) is often cheaper than the other source of funding.

Shareholder’s Equity

Shareholder’s Equity is what is left after assets are subtracted from liabilities. Shareholders equity is also another source of funding for a company, however, oftentimes this source of funding is more expensive. If a company needs more money for investments it may choose to issue stock, the money received for the stock is shareholder equity.

Useful Balance Sheet Ratios

Many useful ratios can be calculated from the balance sheet to get a better sense of either how a company is managing its assets or the underlying value of the company. Here are a few of the most common.

- Current Ratio (Working Capital Ratio): This ratio compares all of a company’s short-term assets to short-term liabilities. The intention is to gauge the company’s liquidity, more specifically its ability to pay short-term obligations due within one year. More on this can be found at Current Ratio.

Formula:

Current Ratio = Current Assets / Current Liabilities

- Quick Ratio (Acid-Test Ratio): This ratio is even more specific than the current ratio. What the quick ratio is trying to take into account is that some short-term assets are not as liquid as others (ex. Inventories, see below). The company cannot force people to buy their inventory so adding this into a liquidity ratio might not give the best picture. The Quick Ratio only takes into account cash, marketable securities, and accounts receivable for current assets. More on this can be found at Quick Ratio.

Formula:

Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

Book Value (Book Value per Share): Although the other ratios can certainly be used by investors, book value is an investor-focused ratio. The objective of this ratio is to figure out the value of the assets of a business if it were liquidated today. Investors may be looking for a company that is trading for less than its assets are worth, if this is the case they may see it as an investment opportunity. More on this type of investing can be found at what is book value.

Formula:

Book Value = (Total Assets – Accumulated Depreciation) – (Total Liabilities)

Balance Sheet Basic Example

To understand how the balance sheet works we can take a look at a few basic examples. First, say a business wants to build a new plant. To do this they will have to borrow money which could be in the form of bonds or bank financing oftentimes depending on the size of the company. Say the company borrows $100,000 for the project. The assets of the company will increase by $100,000 (specifically long-term assets) and the Liabilities will increase by $100,000 (specifically long-term debt) the equation would look like this $100,000 = $100,000 + $0.

The second example, say the company has a profitable year with $50,000 of net profit having nothing to invest it in this goes to a cash account. The $50,000 increases the assets (specifically current assets) but how is the liabilities side handled? There is no true liability from the cash so the cash is represented in shareholder’s equity.

Balance Sheet Real Example

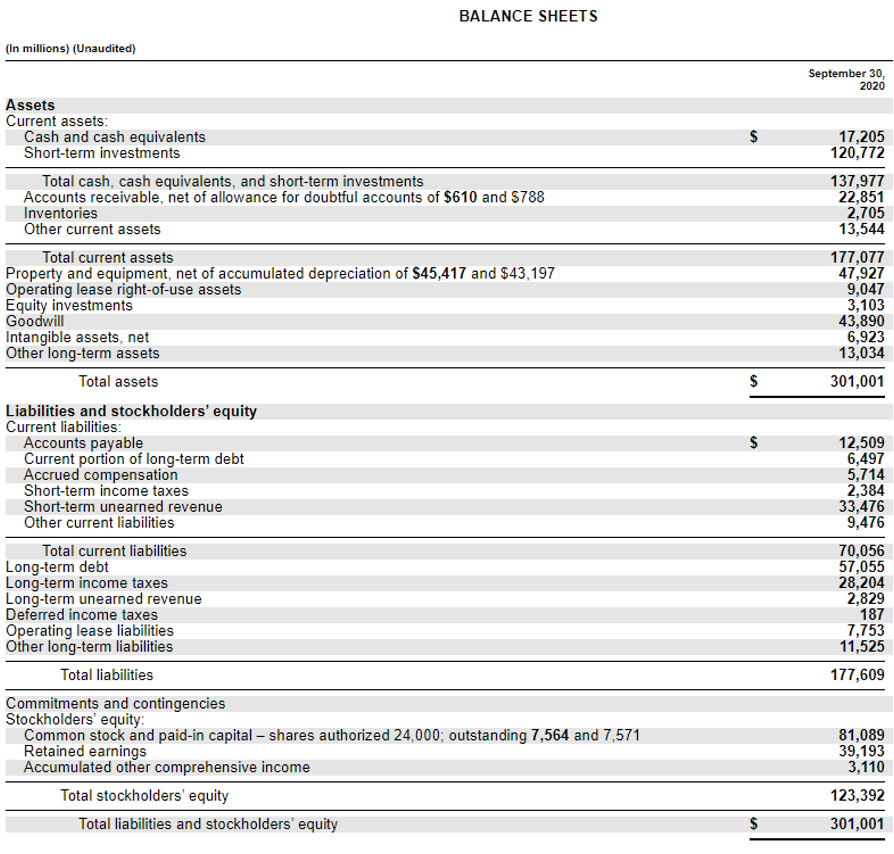

Below is a copy of Microsoft’s (MSFT) balance sheet from their Sep 2020 quarterly report. This example should help solidify the general flow and categorization on the balance sheet. The first thing to notice is that total assets = total liabilities + shareholder’s equity. One more thing to notice is that the phrase long term or non-current is not attached to those respective assets, they are simply listed after current assets.

Where to find financial statement information

Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html. This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10Q, once you find them navigate to “financial statements”.