What is the Current Ratio?

In short:

The current ratio also called “working capital ratio” shows the ability of a company to cover short-term obligations with short-term assets, in other words, does the company have enough cash to pay its debts. The importance of this is to make sure a company can continue operations without problems. The current ratio provides a high level easy to calculate view of this question. To calculate the current ratio divide total current assets by total current liabilities.

Formula:

In-depth:

The current ratio is calculated using the information provided on the balance sheet which is a picture of the company’s finances at a certain date in time, therefore the current ratio is also a snapshot in time. The ratio provides a quick high-level view of the company’s ability to meet its most current obligations. An analogy to this would be “can a person pay their credit card bill this month or do they not have enough money?” it would not answer the analogous question “can a person pay off all their home mortgage today?”.

What’s important to clarify is the “high level” statement about the current ratio. The reason the current ratio is high level is for a few reasons one of which is that of inventory. Companies may have a good idea of how fast they can sell inventory in a normal time, however, if something out of their control were to happen to them or the economy they may not be able to move inventory as quickly. In an event where they couldn’t move inventory as quickly, the company may not have enough liquid cash to pay current obligations.

In line with the reasoning from above, the current ratio is based on the line items stated in the balance sheet. These line items represent large groupings of various other small items. There is a possibility that while yes certain smaller line items fall within the larger line items stated on the balance sheet, you as an investor may not in practice agree with how they are categorized.

Calculating the Current Ratio

To calculate the current ratio by hand simply look at a company’s balance sheet, find the Total Current Assets then divide by Total Current Liabilities. For example, a company that had total current assets of $1.4 billion and total current liabilities of $1.1 billion the calculation would be $1.4B / $1.1B = 1.27 indicating the company would have no trouble covering its current liabilities.

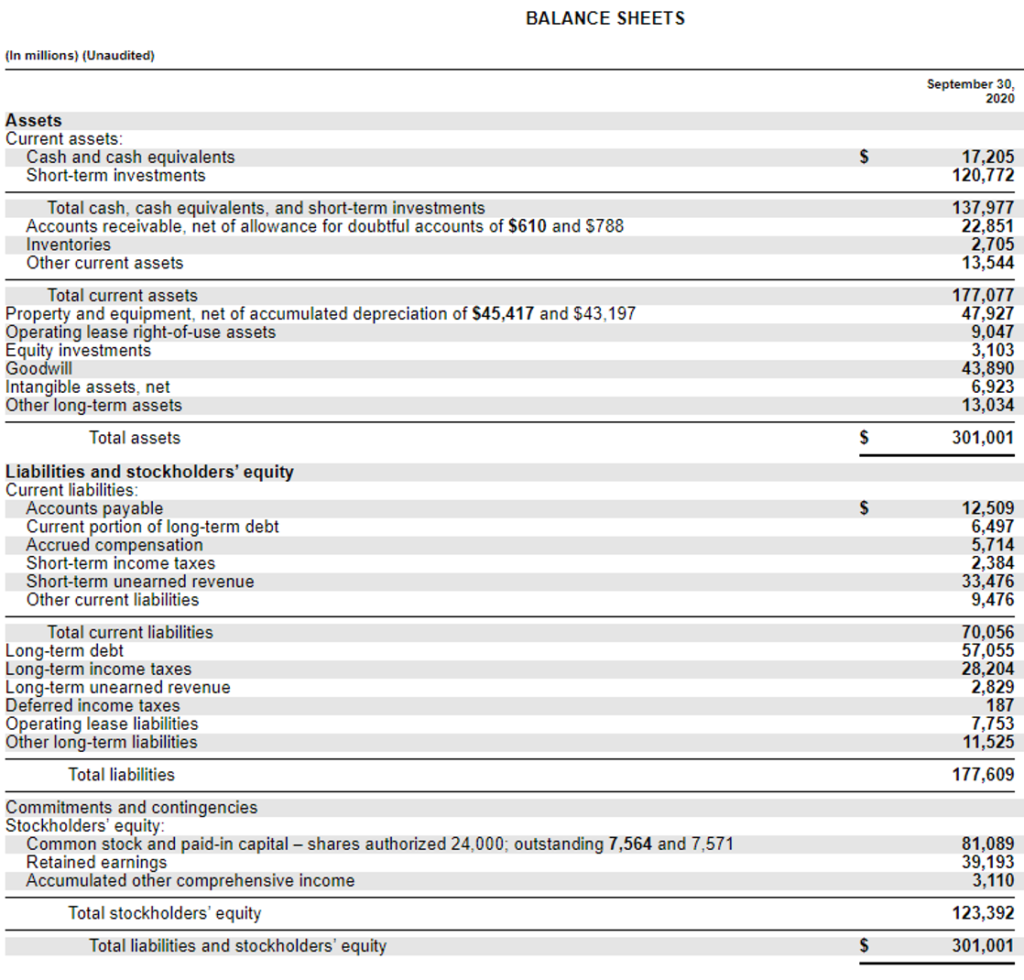

Here is a real-world example using Microsoft (MSFT), we’ll look up MSFT’s most recent quarterly report, at the time of writing it is the Sep 2020 quarterly report. From here we find the balance sheet below.

From here we have total current assets of $177,077 and total current liabilities of $70,056, dividing $177,077 / $70,056 we get a current ratio of ~2.53. What does this tell us? A current ratio of 2.53 would indicate that the company has enough current assets to cover its current obligations.

Where to find financial statement information

Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html. This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10Q, once you find them navigate to “financial statements”.

What is a good Current Ratio?

Taking from the calculation above, MSFT has a current ratio of 2.53 which tells us they can cover their current obligations which is good. That said, to find a “good” current ratio you would need to know the average current ratio for the industry a company operates in. Based on what the average current ratio is for a specific industry you would be able to effectively gauge if the current ratio for a company is “good”. For example, if the average current ratio for the auto industry is 1.2 and the company you are looking at has a current ratio of 2 you would be able to say 1.) the company should not have a short term liquidity problem 2.) you may ask if the company is operating as efficiently as it could be. Maybe the company is holding onto inventory for longer than it should.

One final step to take to gauge if a company has a good current ratio is to look at how the ratio changes over time. If the current ratio is declining ( ie yr 1: 1.5, yr 2: 1.3, yr 3: 1.1) this could be an indication that the company is pulling on more short term debt vs the level of output it is producing this could be bad without knowing the context of the company’s industry.

The main point is to use the current ratio in the light of a certain industry you are evaluating. Another similar ratio to the current ratio is the quick ratio.

Current Ratio FAQs

Generally, a good current ratio is between 1.2 and 2. However, a “good” current ratio will depend on the industry a company is in so you should compare with other similar companies. A current ratio above 1 means the company can cover its short term obligations. Below 1 means the company may struggle to.

The current ratio is calculated by dividing total current assets by total current liabilities and will tell you how easily a company can cover its short-term obligations. These figures can be found on a company’s balance sheet.

A current ratio of 1.2 means that a company has $1.2 dollars of current assets for every $1 it owes in current liabilities. Essentially, the company has enough money to cover its current debts.

A current ratio of 2.5 means a company should have no trouble covering its current obligations, or in other words, the company has sufficient liquidity. While this is good in that it reduces default risk too high of a current ratio may be a sign the company isn’t using its capital efficiently. To know this for sure, the current ratio should be compared with the average of an industry.