Do current assets cover current liabilities?

What is the Quick Ratio?

In short:

The quick ratio, also referred to as the acid-test, is a measure of a company’s liquidity, more specifically it shows the ability of a company to meet its short-term obligations given its current assets. The ratio is sometimes used instead of the similar current ratio because the quick ratio is more conservative in its measure of short-term assets. To calculate the quick ratio simply add cash, marketable securities, and accounts receivable together then divide by current liabilities.

FORMULA:

In-depth:

What the quick ratio is trying to take into account is that some short-term assets are not as liquid as others (ex. Inventories, see below). The company cannot force people to buy their inventory so adding this into a liquidity ratio might not give the best picture. The ratio only takes into account cash, marketable securities, and accounts receivable for current assets.

Different Ratio Values

Once a quick ratio is calculated what does the value mean? The ratio value will be either larger than or less than 1 if it is 1 that indicates that the company has just enough current assets to meet its current liabilities once again without accounting for inventory. A value of less than 1 indicates the company may have trouble covering its liabilities if an unexpected event were to occur. Conversely, If the quick ratio is larger than 1 this indicates that the company would likely have little trouble covering its current liabilities.

Best Ratio Value

What is a good quick ratio? This question is best answered by looking at what typical values are for the market sector that the company operates in. Depending on industry type it may be common to have a ratio of less than 1, in this case, a ratio of greater than 1 may be a sign that the company isn’t being efficient. The main point to takeaway in such a case is that the company needs more investigation as to why they have a quick ratio outside the normal.

Importance

What’s the importance of the quick ratio other than being a more conservative measure than the current ratio? As stated previously, inventory is not included in this ratio. Not including inventory allows an investor or management to look at how the company might be able to handle unexpected events. These unexpected events could cause the customers who owe the company money to be late in paying. If a large number of customers are late paying while the company needs to pay its own bills it may not have enough current assets on had to make good on those payments. A recent real example of an event that might cause such problems is the COVID19 pandemic that swept the world in 2020.

Example Calculation

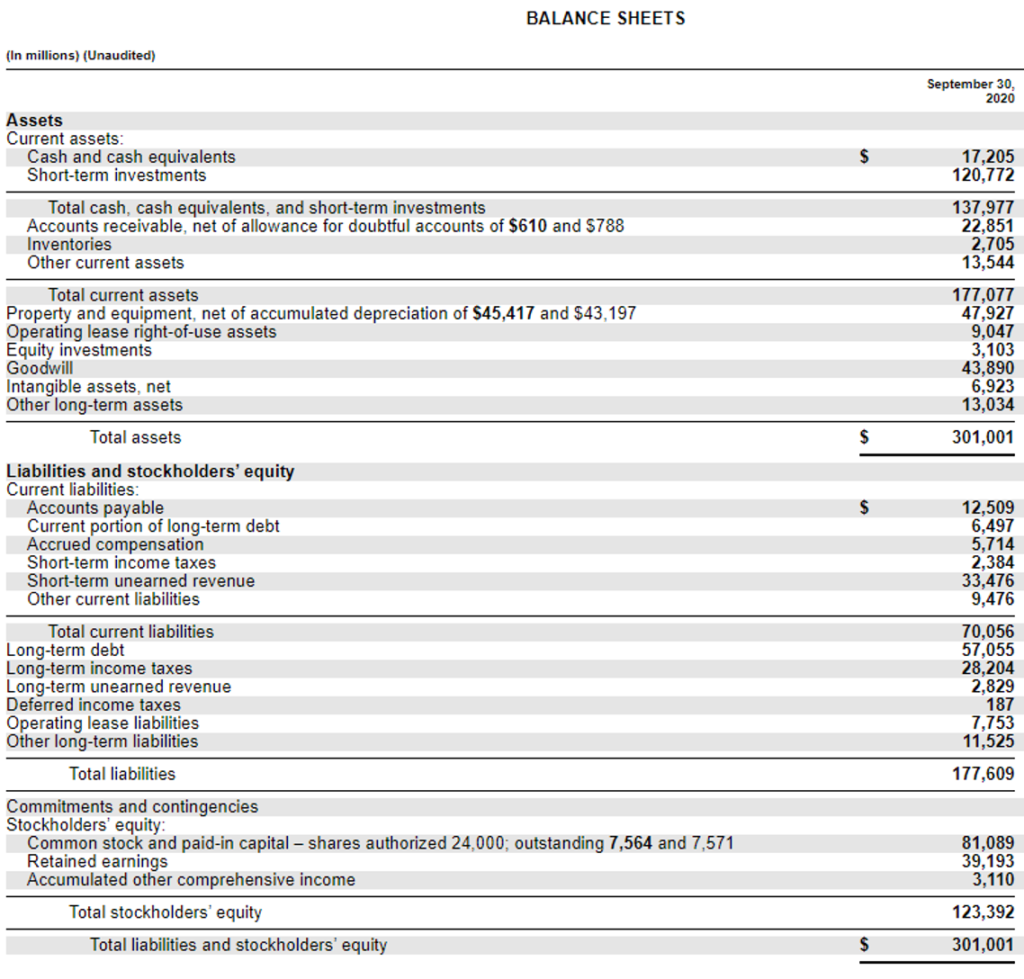

Below is a copy of Microsoft’s (MSFT) balance sheet from their Sep 2020 quarterly report. To calculate the quick ratio we will add all current assets except inventory and other current assets, then we will divide by total current liabilities.

Quick Ratio = (17,201 + 120,772 + 22,851) / 70,056

Quick Ratio = ~2.3

What we can take from this is the Microsoft has plenty of current assets to cover its current liabilities even if it can’t move its inventory as expected. What you would need to do next is compare this ratio with the industry to see if it deviates from the normal.

Where to find financial statement information

Since the quick ratio is slightly more detailed than the current ratio, finding it already calculated via stock data websites might be a bit more challenging. That said, it is fast and easy to get the information and calculate the quick ratio on your own. To do this you will need to get a company’s financial statements.

Finding the financial statements of a publicly traded company is easy. Simply look up a company’s 10-k (annual statement) and/or its 10-Q (quarterly statement) which can be found on EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html. This site is run by the Securities and Exchange Commission (SEC), you can enter the company you want to know and it will pull all the statements.

Once you get to the site enter the company name or ticker, look for their most recent 10-k or 10-Q, once you find them navigate to “financial statements”.

Additional Resources: Acid-Test Ratio | Explanation and Example