– Popular Online Brokers –

*We do not receive any compensation for our review of this company’s product or services or for the use of the link we provide to their site.

E*TRADE Overview:

E*TRADE is no newcomer to the online broker world, as a matter of fact, they are more of a legacy online broker having started in the early 1990s and have been slow to arrive to the commission-free trades train. E*TRADE’s target audience is a combination of active traders and long-term higher net worth investors as can be noted with the questions they ask when setting up an account as well as the robust resources including Bloomberg TV. The broker provides not one but two web-based trading platforms and mobile apps depending on the needs of the investor.

New users signing up online will find the account set up easy to navigate with more questions than some brokers but likely taking only around 10 minutes. Funding an account can be done by linking a bank account and initiating a transfer.

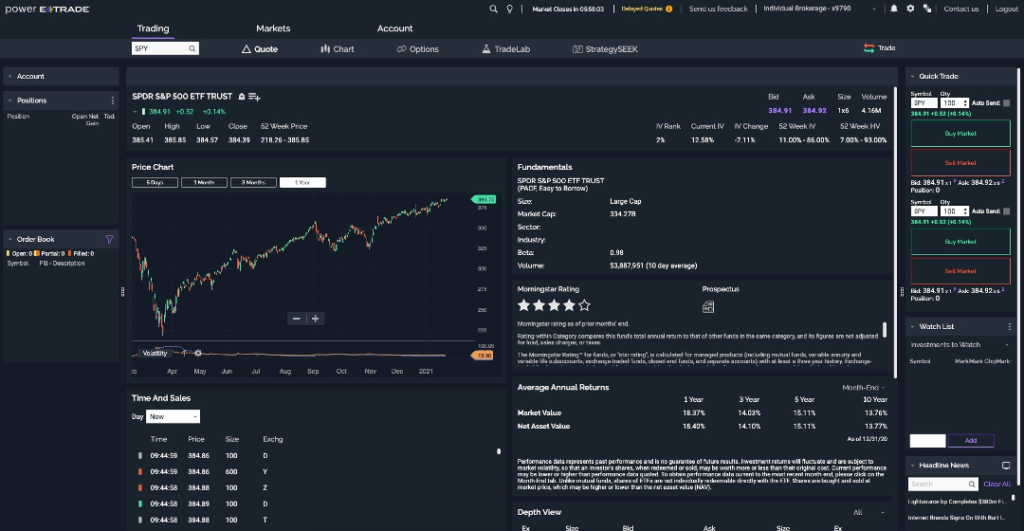

With a brief look at a customer account dashboard, it is clear that E*TRADE is focused on being a very comprehensive online broker serving the variety of needs a more seasoned investor or active trader may have. While the complete view account page (main web page for a logged-in account) provides access to many of the features, the page forfeits some cohesive flow that could guide the initial ease of use of the platform. Likely, given the minor lack of cohesiveness along with the number of features and options available with E*TRADE it will take some time to explore the site before an investor would become comfortable/knowledgeable of what is available to them.

The longer potential onboarding and learning cure for an investor using E*TRADE is a trade-off for the tools, resources, and width of tradable assets they gain by using E*TRADE. An investor will be able to trade a large range of stocks, bonds, mutual funds, ETFs, and options on the platform at varying costs starting at $0 commission trades on stocks. An investor looking for a hands-off approach has the ability to get a custom-built and managed portfolio so long as they meet the minimum investment threshold. However, if this is the case the investor may likely be better at finding a local financial advisor who would likely be able to achieve similar results.

Our Ratings:

E*Trade Strengths and Weaknesses:

Strengths:

- Trading Platform

- E*TRADE boasts not one but two different trading platforms available to their customers depending on their needs. The traditional E*TRADE trading platform for less active investors and Power E*TRADE for active traders wanting a more cohesive workflow and dynamic toolset.

From both platforms, an investor can access similar information and granular details such as a large number of charting studies, company overviews/analyst research, option chains, level II data (if subscribed). However, placing a trade and accessing your watchlists is much faster and easier on the Power platform whereas the traditional platform is not as clear and takes a few more steps. The biggest drawback on both is that customizing the chart for a quick view of a company cannot be done, rather you must enter the chart tab to have a more detailed view.

- Research/Education tools

- From analyst research to stock screening tools, the initial heavy lifting of sorting through investment options can be lightened on E*TRADE. On the desktop version of the site, an investor can find hundreds of research reports from the likes of Morgan Stanley, Thomson Reuters, Argus, and more. On top of that, an investor can create their own search criteria via the stock screener which allows for sorting based on market segment, some technicals, some relative ratios of fundamentals, and more. That said, while the stock screening filter can be useful it is not overly robust.

- On the education side, E*TRADE offers a wide range of information and videos on topics. These videos often feature different instructors who do a fairly well job at explaining the topics although a meaningful amount of digging around by the user will be needed for them to find what they are looking for.

- Tradable Assets

For someone who wants access to almost every form of tradable asset, they will be able to find it on E*TRADE. From penny stocks to some 9,000 mutual funds to futures and options and bonds. This variety of tradable assets is a big plus for the more advanced and active investor regardless of their current strategy.

Weaknesses:

- Costs

- E*TRADE was slow to join the commission-free train and still seems to hold on to some of the tiered fees which other brokers have let go. For example, options contracts are $.65/contract and come down to around $.50 for active traders. There are a few other fees that an investor or active trader may run into such as a broker-assisted trade fee or varying depending on what asset they are dealing with. That said, stock and ETF trades are commission-free.

- Simplicity

Looking at the ease of setup and use of the services E*TRADE offers it is very likely that an investor coming to E*TRADE would find some difficulty in finding the main functions they would engage with on a regular basis. Certainly, the broker provides a variety of resources, however, the organization and presentation of those resources are lacking. In our opinion, this matters and should matter to a user, since having access to a resource you don’t know about is just as good as not having the resource. Not only do we find this issue on the website, but we also find this on the trading platforms and mobile apps where a fair amount of navigation is required on the part of the user.

*It should be noted that quick access to E*TRADE via a phone is a major plus in our view as accessibility to your broker in case of emergency is important. However, we found the response time via email to be very untimely.

E*Trade More In-depth:

The strength of E*TRADE can be felt for more advanced and active traders. They will be able to fully appreciate the suite of resources available to them when opening an account. From advanced charting capabilities to access to analyst research and the different types of accounts, they can open. It should stand as no secret that E*TRDAE is a full-service broker offering all the bells and whistles one could expect from a broker that has been operating in the online space since before it was cool.

While E*TRADE offers some educational tools that could be helpful to a new investor, it is clear that their target audience tends to be active traders and long-term higher worth, investors. The abundance of resources and slight complexity of their presentation may at first be information overload and depending on the intensity with which a new user wants to pursue investing an entire turn-off. That said, given enough time and energy E*TRADE would likely prove to be a good choice for many investors.

Our biggest concerns, although few, would be in the response time to email inquiries which were longer than we’ve experienced with other brokers, the fee structure which shouldn’t be an issue for most uses, and the layout of their site and trading platforms which become easier to use with time.