In short:

Net Operating Profit After Tax or NOPAT represents a company’s net earnings after taxes if the company did not have debt. Since most companies have debt, NOPAT is a theoretical value used to compare companies on a capital structure neutral basis. To calculate NOPAT, a company’s earnings before interest and taxes (EBIT) is multiplied by ( 1 – tax rate ).

Other calculations such as economic value added (EVA) or free cash flow to the firm use NOPAT as the main component of their calculations.

Formula:

Key Points

- Net Operating Profit After Tax (NOPAT) is a theoretical value that represents the net income of a company if it had no debt.

- NOPAT is a starting point when calculating unlevered free cash flow as it represents income attributable to all investors (debt & equity) not just equity investors.

- Net income is associated with equity value whereas NOPAT is associated with enterprise value.

- NOPAT is calculated completely from figures on the income statement.

In-depth:

What NOPAT Tells Us

Net operating profit after tax (NOPAT) shows what the core operations of a company are currently earning from capital provided by all investors. Since most company’s operations are funded with capital from both debt and equity investors, NOPAT gives insight into how profitable a company’s core business is.

Part of the value here is that NOPAT does not include one-time gains or losses that otherwise would not provide a true representation of a company’s profitability.

Additionally, NOPAT does not include the tax savings companies receive from interest on debt, therefore analysts often use NOPAT to calculate the economic value added (EVA) of a company. That is, does this company generate enough profit from its core business to cover the cost of the capital it is currently consuming.

Understanding NOPAT in Valuing a Company

Net operating profit after tax (NOPAT) is a company’s core earnings if it had no leverage. But why is knowing a company’s core earnings without leverage important? When looking for the value of a company, the main question being asked is “what is the core business operations worth?” -we are not worried about non-recurring gains and losses since they are not likely to happen repeatedly.

To answer this question an analyst will need to calculate the unlevered free cash flow of a company, then discount those free cash flows back to their present value.

NOPAT serves as the starting point for this as it represents the core net earnings of a company, i.e. repeatable earnings, available to all investors (debt & equity).

From there, analysts adjust this figure even further to reach unlevered free cash flow by adding back non-cash adjustments (such as depreciation & amortization), change in working capital, and subtracting capital expenditures.

Example Calculation of NOPAT

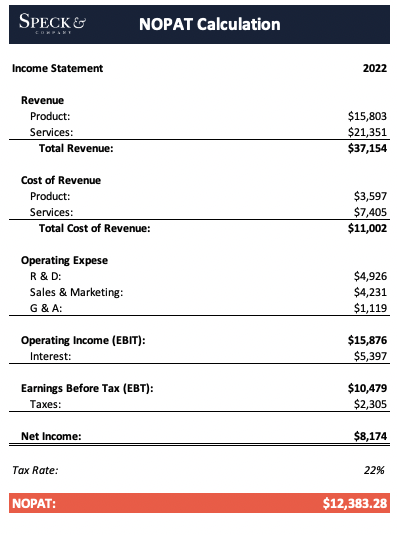

With the importance of NOPAT, how do we actually calculate it? To understand better how to calculate NOPAT, we can look at a brief example using the sample income statement below:

If we were given the income statement above and asked to calculate NOPAT, we would first want to identify our earnings before interest and taxes (EBIT). We’re using EBIT because interest and taxes are still in this figure. In the case above, we can see that our EBIT is $15,876. Next, we need to remove taxes since NOPAT is after-tax. To do this we identify the effective tax rate for this company which is 22%. At this point we can apply the NOPAT formula of EBIT x ( 1 – Tax Rate ) which would look like the following in our case:

NOPAT = $15,876 x ( 1 – .22)

NOPAT = $15,876 x ( .78)

NOPAT = $12,838