The minimum required rate of return for an investment

In short:

The hurdle rate is the bare minimum rate of return that can be accepted on a project by a company, i.e. it is the “hurdle” the project must surpass. This value will help to determine if an investment should be made or not.

The hurdle rate will be primarily derived from a combination of the cost of capital and the risks of the project. This value will then be used to compute the net present value of the project and/or compared against the project’s internal rate of return.

Key Points

- A hurdle rate is the minimum rate of return that can be accepted on a project by a company and is usually a reflection of the company’s cost of capital and the risk associated with the project.

- Hurdle rates provide companies a means to decide if a project will be financially beneficial or destructive.

- Often a company’s weighted average cost of capital will be used as the hurdle rate.

- The hurdle rate will be used as the discount rate in the net present value calculation.

In-depth:

How is the Hurdle Rate Used?

So what exactly is the hurdle rate and how is it used? When a company is looking at taking on a project they need a way of measuring whether or not it will be a valuable project. To do so they need to determine if the project will return more than the cost of the capital it consumes and account for the riskiness involved.

To figure out the cost of the capital a project will consume a company will typically use its weighted average cost of capital. This represents the weighted interest rate the company is paying for borrowed money and the money it has sourced from equity investors.

When accounting for risk the hurdle rate may also include a risk premium depending on the riskiness of the project. For example, for a project that has more risk than the risk of the firm a risk premium is likely to be added meaning the project must return a premium to the WACC to be considered break-even.

Once the hurdle rate is established, a company has two ways to evaluate the viability of the project.

The first is to compare the hurdle rate to the internal rate of return (IRR) of the project. If the IRR of the project is greater than the IRR the project is likely to be constructive. This means that the project is yielding a greater return than the cost and risks associated with the project. However, the rate of return of a project is not the only thing a company will consider but also the absolute dollar return of the project.

The second way to evaluate the viability of a project considers the absolute dollar return using net present value. If a company wants to estimate the nominal dollar return a project will provide they will discount the future cash flows of that project back to today. The rate at which the company will discount future cash flows is the hurdle rate. If after discounting future cash flows results in a value greater than the initial investment the project is considered constructive by that dollar amount.

Factors that influence the hurdle rate

While a company’s WACC and a project’s risk will be the main drivers of establishing the hurdle rate, other factors can influence it. These factors include the current interest rate environment as they will affect opportunity costs on other investments and the current inflation rate.

Hurdle Rate Example

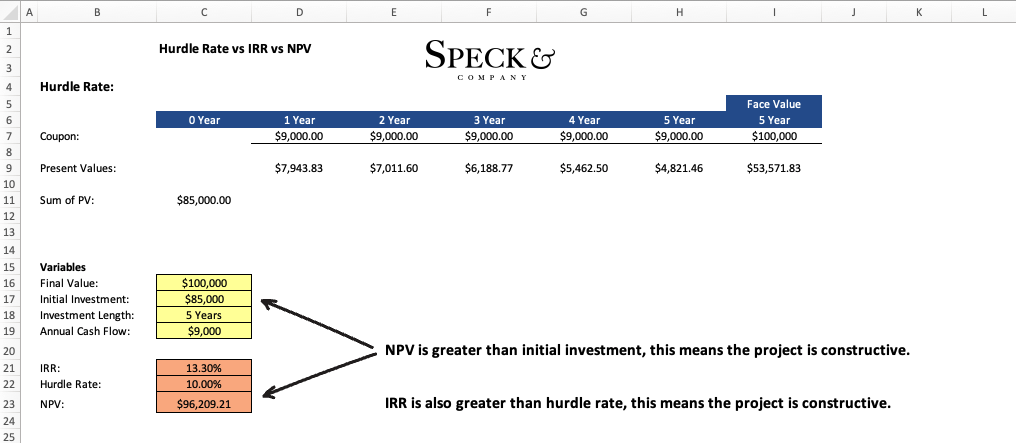

To make better sense of the hurdle rate we can take a look at an example. Let’s say our company is looking at a 5-year investment that is expected to cost $85,000 upfront and produce $9,000 of cash flow each year. At the end of the 5th year, we are planning on selling the investment and reasonably believe it will be worth $100,000. The last additional piece of information we need is our hurdle rate which, in this case, is 10%.

First, we calculate the internal rate of return of the investment to be 13.3%. While this initially tells us the investment will be constructive it does not indicate by how much in absolute dollar terms. For this, we calculate the net present value of the investment by discounting all future cash flows by our hurdle rate. The NPV value we get before subtracting our initial investment is $96,209.21 meaning this investment will produce an additional $11,209.21 in value for the company.

The reason why knowing this additional absolute dollar amount is important is that often a company will prefer the investment with the largest NPV.

Hurdle Rate vs IRR vs NPV

The terms hurdle rate, internal rate of return, and net present value will often be used in a similar context with one another. This is because they are all used when determining the economic viability of an investment or project.

Internal rate of return refers to the annualized compounding rate of return on an investment or project. This value will likely not be the same as the hurdle rate.

Hurdle rate refers to the company’s weighted average cost of capital and the risk associated with a certain project. Additionally, the impact of interest and inflation may be included. This is the minimum return rate a project must make.

Net present value is the nominal dollar value the project or investment will yield when discounted by the hurdle rate. If the value is positive the investment will be considered constructive whereas if it is negative then the project is capital destructive.

Frequently Asked Questions

A hurdle rate is the minimum rate of return that can be accepted on a project by a company and is usually a reflection of the company’s cost of capital and the risk associated with the project. If a project can earn a higher rate of return than the hurdle rate it is considered to be constructive.

The hurdle rate is calculated by account for a company’s weighted average cost of capital (WACC) and the risk associated with the project called the risk premium. The resulting value will be the hurdle rate which represents the rate of return a project must be in order to be considered.

IRR and hurdle rate are not the same thing. Internal rate of return refers to the annualized compounding rate of return on an investment or project. Hurdle rate refers to the company’s weighted average cost of capital and the risk associated with a certain project.