Quickly calculate the weighted average cost of capital.

In short:

If you work for a company looking at a capital budgeting project, are an investment analyst, or a student in a corporate finance class odds are you’ll need to know what weighted average cost of capital is (WACC) and how to calculate it.

Put simply, WACC is the average cost of funding from all sources for a company, that is both debt (bonds & banknotes) and equity (common & preferred stock). While WACC is a weighted average calculation that could be performed by hand, it is best to calculate WACC in excel to automate the calculation, reduce human error, and make adjustments easier.

Key Points

- WACC is a business’s cost of capital, or more simply, the cost to finance its business from both debt and equity.

- WACC is used by a firm to identify their hurdle rate, that is, the minimum rate of return a project must have in order to be viable.

- The calculation of WACC will always yield an estimated value as it is not realistic to say WACC is exactly a certain value.

In-depth:

We have included the excel file we use in this example for free if you would like to use it to follow along.

WACC Formula

Intuitively WACC should be a simple idea as it is the weighted average of all the costs of each source of funding. Unfortunately, WACC can be a bit tricky to calculate since there are additional calculations that need to be made to get each component of the formula.

The best approach is to look at the WACC formula, then look at how we can calculate each component of the formula. Below we have included the formula for WACC, in the case a company doesn’t issue preferred stock this part of the equation can be dropped.

WACC Formula:

Looking at the debt section of the equation we will multiply by (1 – Corporate Tax Rate). The reason for this is that the interest on debt is tax-deductible since it is a cost to the business, however, dividends on common and preferred are not.

At this point, if we already have each component of the formula we can simply insert them and calculate WACC. However, if we do not have each component we must go and find/calculate each component.

Cost of Debt Calculation

When calculating the cost of debt we have two options.

Option 1, we can calculate the cost of debt using the yield to maturity of the outstanding debt. By using the YTM we would be reflecting the current cost of debt to the company if they needed to issue additional debt since it reflects the current value of the debt.

Ideally, we would use the YTM version, however, we may not have enough time to find the relevant information, or it’s not possible to find the current market value of the debt.

In this case, we would use option 2, which is to calculate the cost of debt based on the book value of debt.

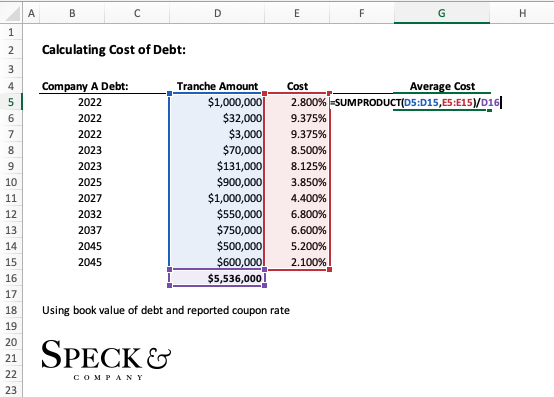

In either case, we want to find the value of the tranches of debt and their associated interest rates. From there we can use the “=SUMPRODUCT” function to calculate the average cost of debt. We have included an example below:

Cost of Equity Calculation

When we calculate the cost of equity we will use the CAPM formula which is as follows:

Cost of Equity = Risk-Free Rate + Levered Beta x Equity Risk Premium

The difficult part of this formula is the levered beta part depending on our use case. If we are running a quick WACC calculation we can use the beta from Bloomberg or Yahoo Finance, however, if we are using WACC in a valuation we need to use a more involved process.

Unlevering Betas

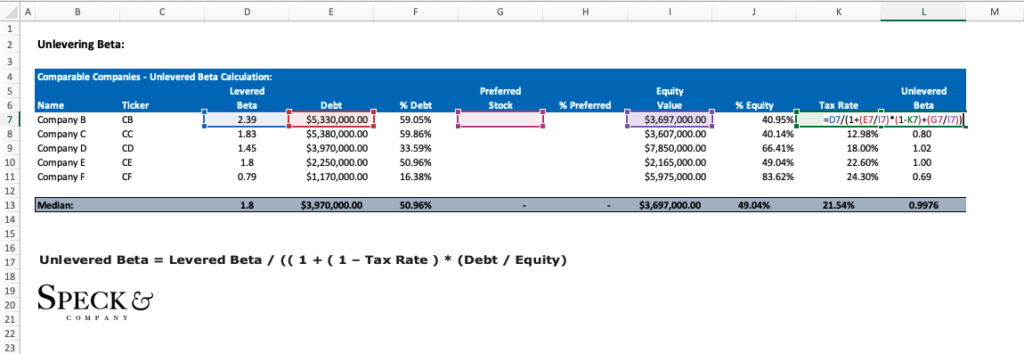

Assuming we’re using WACC in a valuation, we will need to find comparable companies (size and business type). We will collect their betas and capital structures so we can unlever them and find the median unlevered beta.

The reason we do this is to find the standard amount of risk for this business type without the influence of leverage (debt). We’ve attached an example of this below:

*You find the levered beta simply on a site like Yahoo Finance

Relevering Betas

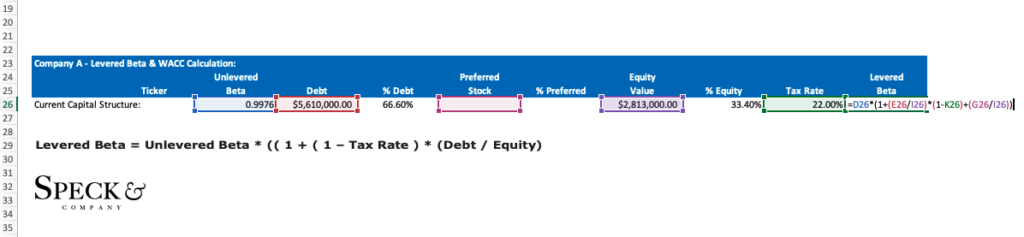

Once we have the median unlevered beta for like-type businesses similar to the business we’re calculating WACC for we want to relever that beta to include the risk from the amount of leverage (debt) our company has. We’ve attached an example of this below:

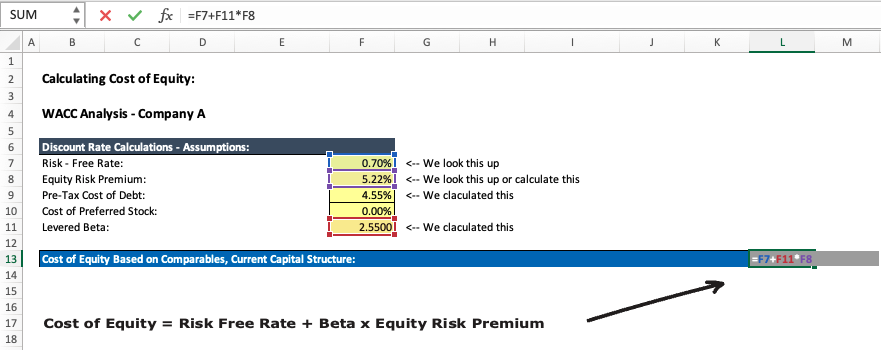

Applying CAPM

The other pieces of information we will need are the Equity Risk Premium (ERP) and the Risk-Free Rate (RFR). The ERP can be found at publications such as Ibbotson’s or Professor Damodaran’s website, the easiest is Damodaran’s website. For the RFR we can simply look up the 10-Year U.S. Treasury rate as long as the revenue of the company is primarily in US dollars.

Finally, at this point we have all the relevant information we need to apply the CAPM formula which we have attached an example of below:

Calculating WACC in Excel

Collecting everything together in one sheet we could display all the information for the WACC calculation as follows: