The annualized rate of return on an investment or project

In short:

The internal rate of return IRR is the discount rate that makes the net present value of all future cash flows equal to zero. This definition, while being precise, explains the idea behind calculating IRR but not how to use IRR.

Another way to think about IRR is as the compounded annual rate of return of an investment or project which can be used as a standard measurement for comparison. The advantage of IRR is it provides an estimate for the annual return on an investment that an investor or company makes.

Often, when comparing internal rates of returns an investor or company will prefer a higher IRR if the same risk is involved. Think of it like this, would you want to own a stock that returns 10% a year or a stock that returns 13% a year with the same riskiness? IRR could be thought of as the measurement of the annual percentage return of the stock and the stock as the investment.

Key Points

- The internal rate of return is the annual percentage return of an investment or project.

- IRR can be used to calculate the annual growth if the initial investment, expected annual cash flows, and final value of the investment are known.

- IRR is often used as a comparison metric for corporate projects either between projects or to ensure the project’s return is greater than the company’s capital costs.

In-depth:

IRR Formula and Calculation

Since the idea behind internal rate of return is to find the discount rate (rate of return) that makes the present value of future cash flows equal to zero we can illustrate the formula as follows.

In the illustration above, each cash flow received is “discounted” to what it would be worth if it was received today. These values are then summed together where when the correct discount value is found, their sum will be equal to the initial investment. For this reason, academics say IRR is the discount rate where the net present value of future cash flows is equal to zero.

To understand this process, we can look at a scenario to see how the formula works.

Say we are looking at an investment that would initially cost us $60,000 and we believe we could earn $10,300 per year in cash flow. In addition to this, we believe if we held the investment for only 5 years, we could sell the investment for $160,000.

Taking $60,000 and turning it into $160,000 in 5 years on top of making $10,300 per year sounds really good, but what would our annual rate of return be in this case? Using the formula above, we could apply a guess and check method to find the correct rate or return.

Calculating IRR In Excel – Hard & Easy Way

While it’s good to understand the mechanics of what is going on behind the scenes of the IRR calculation. Calculating the IRR by hand is not a practical thing to do as it would require this time-consuming guess and check approach to approximate the correct discount rate. Instead, we can use excel to automate the process for us.

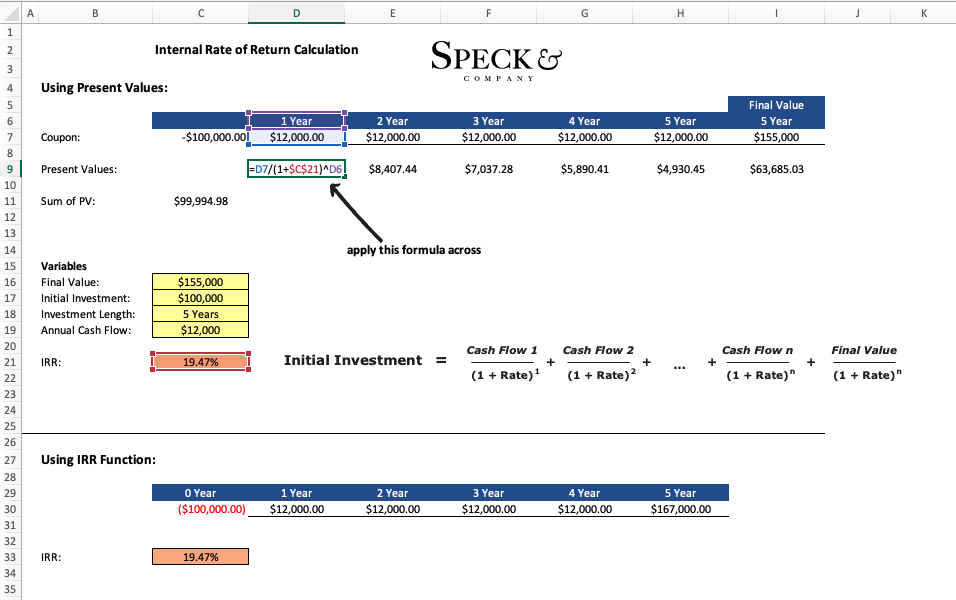

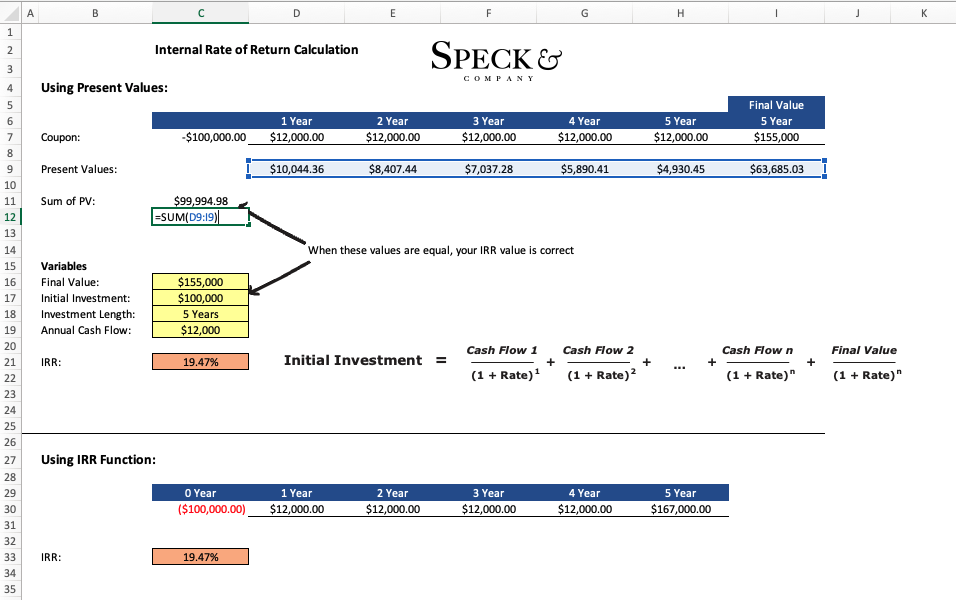

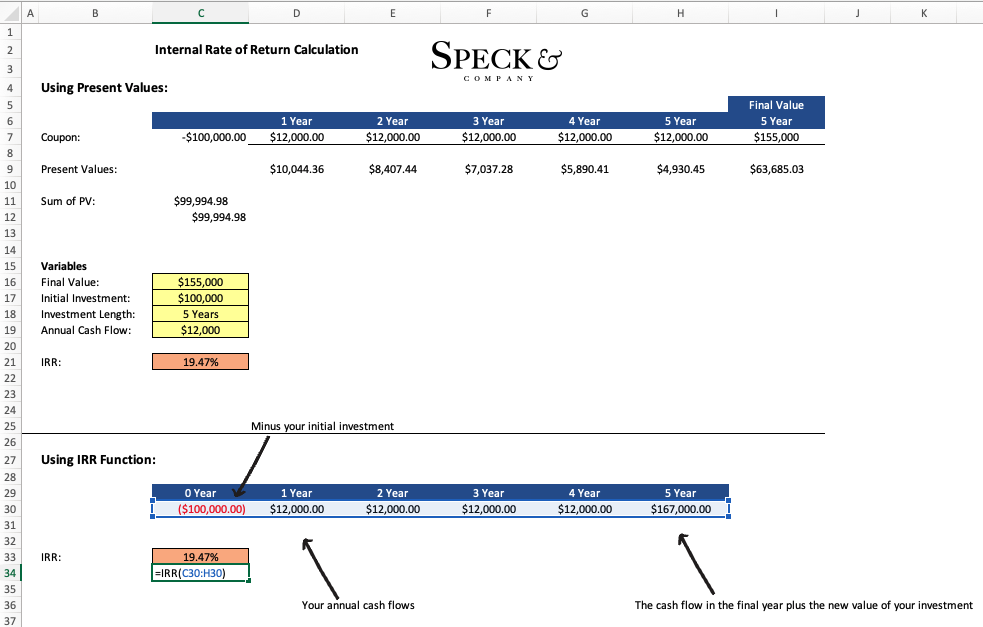

Here’s an example that we’ve set up in excel.

Say we are looking at an investment which would require us to initially invest $100,000, we would hold the investment for 5 years, at the end of the 5th year we believe we could sell the investment for $155,000, and while we are holding the investment we would make $12,000 a year in free cash flow. What is the IRR for this Investment?

From this point, we have multiple ways we can find the IRR in excel. Here is both the approach of applying the formula from above where we guess and excel recalculates for us and using the more simple “=IRR” function built into excel.

Step 1 – Using the Formula and Manually Discounting the Cash Flows

Final Result – When you Know you have the Correct IRR

Using the prebuilt IRR Function

What Really is IRR

So, what really is the internal rate of return and how is it used? The best way to think about this is from your own perspective as if you were trying to make an investment decision for yourself. The question you would be asking is, which investment gives me a better annual return?

For example, say you were looking at two different stocks and you wanted to figure out which one you should invest in. How would you begin to decide between the two? One thing you might do is look at their past annual returns which would give you a metric to compare them by.

Now if both stocks are of the same riskiness, meaning you have the same potential to lose money or not have the return you expected, you would probably choose the stock that had the higher average annual growth rate. This would ideally give you the best shot at growing your investment the most.

This analogy serves as a good comparison for IRR since IRR gives investors a tool to calculate the average annual return of an investment where it might not be as easy as looking up annual returns on stocks. That said, IRR isn’t used just in what might be thought of as typical investing.

Companies will often use IRR to compare projects to one another when deciding which project is better for them to spend their resources on. That is, if a company knows how much a project will initially cost and what they can reasonably expect to earn in cash flows, they can compute the project’s expected annual average return with IRR.

Decision using IRR and WACC

One major reason companies calculate the IRR of a project is to compare it to their weighted average cost of capital (WACC), also called the hurdle rate. WACC represents a company’s cost of funding, so it is important for the company to ensure every project they take on gives them a greater return than what it costs the company to source the funds.

Let’s look at a simple example that may illustrate this point better. Say we are real estate investors currently looking at a single-family home which would initially cost us $100,000 to buy and we would hold for 5 years. We believe we could net $12,000 of income off this property per year, that is $12,000 after we pay all maintenance, taxes, insurance, and account for vacancy. Finally, our estimate is that we could sell the property for $135,000 at the end of the 5th year.

To keep it simple, we plan to pay cash for the property. This means that our WACC is simply the cost of our equity (cash). If we say our equity could generally earn 10% per year since we could at minimum put it in a S&P 500 index fund, then our WACC could reasonably be set at 10%.

What we would need to do now is decide if the real estate investment is a good investment or if we should just put our money in an index fund. To do this, we need to compare the IRR of the real estate deal to our WACC.

When we compute the IRR of the real estate deal we find it is 17%. Comparing the 17% IRR to our WACC which is 10% the real estate deal turns out to surpass the minimum return we need to justify the deal so we buy it.

Companies use the same general approach when looking at projects, the difference may be their WACC includes debt which could make the WACC calculation more complex.

Deciding Between Two IRRs – Absolute Dollar Value

While internal rate of return (IRR) is a very useful and important tool when evaluating projects or investments, there is another aspect companies and investors will want to consider in addition to IRR. That is the absolute dollar value gain of a project or an investment.

If we use the simple real estate example from above but add-in that we are a real estate investor with $3 million to invest, the decision we made might change. No longer is our goal to simply select the project or investment with the highest IRR. Now we need to maximize the gain of all our capital.

Say as real estate investors we have to decide between the 17% IRR single-family house from above or a multifamily deal which costs $2.91 million, will generate a net income of $220,000 per year, and we reasonably expect we could sell it for $3.5 million at the end of the 5th year. Which deal should we take?

In this case, the IRR of the multifamily deal is 10.83%, only slightly higher than our WACC of 10% and over 6% lower than the IRR of the single-family deal. In this case, while the multifamily deal is only slightly better than our WACC and much lower than the single-family deal we would still choose the multifamily deal as the nominal absolute dollar value generated of this investment is $1.69 million vs $95,000 on the single-family property.

Why did we choose a lower return? We choose the lower return because even with the lower return we would push the total earnings of our investment higher than if we choose the higher returning investment. The process we went through above is in line with how the decision process might go within companies trying to decide between different projects. The difference may lie in the complexities of the projects or investments and the WACC calculation will not be as simple.

Internal Rate of Return (IRR) vs Return on Investment (ROI)

Internal rate of return (IRR) and return on investment (ROI) are not the same thing and should not be confused with each other.

Return on Investment is the total percentage increase from the beginning to the end of a project or investment. For example, you buy a share for $100 hold it for 3 years and sell it for $160, your ROI is 60% [ ((160-100) / (100)) x 100].

ROI does not give an annual return, rather the return over the entire life of the investment. If we were to calculate the IRR for the same investment, we get to 16.96% which is not only a different value but an altogether different measurement.

Frequently Asked Question

IRR tells you the compounded annual rate of return of an investment or project which can be used as a standard measurement for comparison. Formally, IRR is the discount rate that makes the net present value of all future cash flows equal to zero.

A good IRR is one that is higher than the company’s weighted average cost of capital WACC otherwise called the hurdle rate. This is the cost the company incurs to source funding, therefore you want an IRR on a project to indicate the project makes more than it costs to fund the project.

When comparing IRRs, a high IRR is better. However, there is more to deciding if a project is worth undertaking. Usually, companies will compare absolute dollar values of projects in addition to IRRs where a higher absolute dollar value may be preferred.