Different names for the same concept

In short:

Par value and face value are two different words that refer to the same thing in the context of financial securities. That is, the minimum value placed on the security in the eyes of the issuing company at the time of issuance.

While bonds are always assigned par values it is not uncommon for stocks to be assigned par values as well. When a par value or face value is assigned to stock, this represents the minimum but not the maximum value a company can accept in exchange for their shares. Today, face value is often still assigned to stocks as a result of old state regulations requiring par values, however, it is almost useless in representing value as usually it is set to 1¢ or less.

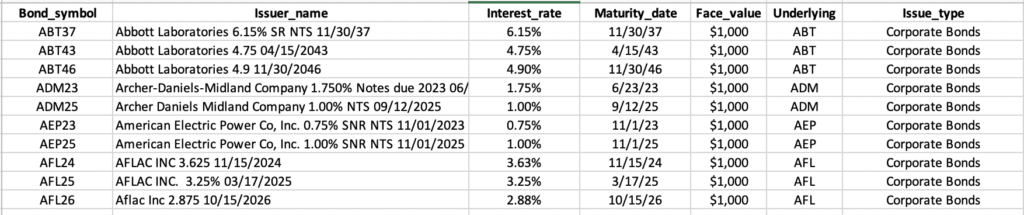

Par value in the context of bonds represents the promised dollar value to be returned to the bondholder at the expiration of the bond. In addition to this, par value helps determine the coupon value which is the nominal amount the bondholder will receive as interest on their investment. Typically par values on bonds are either $1,000 or $100 however, they can be set at any value.

Key Points

- Par value is the nominal fixed value assigned to a bond or share of stock when they are initially issued.

- Par value represents the promised amount by the issuing company to be returned to bondholders.

- In stock, par value has minimal relevance and is not an indication of true value.

In-depth:

Par Value vs Face Value

Par value and face value can be used interchangeably for both bonds and stock. Typically, par value is used more often in regard to bonds and face value in regard to stock. That said, focus by the investor often shouldn’t be placed on the par or face value of the security but rather the company that is issuing the security.

In addition to the discussion of face value of stock from above, it is valuable to discuss why many companies set the face value of their shares at 1¢ or below. Since face value of stock is commonly accepted as having no relevance to the true value of the shares, a company may set its par value low to allow initial investors and founders to acquire initial shares without the need to outlay large amounts of capital.

This will still allow a company to request more for its shares when initially issued, say $26 instead of 1¢. However, in the case of bankruptcy, the founders and initial investors who paid less than $26 for their shares would not be liable to make up the difference.

Par value plays a much more important role in bonds as it is the benchmark price from which all other aspects of the bond can initially be calculated. That is, the par value will determine the coupon amount to be paid to the bondholders. From both the annual coupon amount and the par value, investors could calculate the initial interest rate of the bond.

Eventually, investors will need to use these components to calculate the effective current yield and yield to maturity as the market price of the bond changes.

Par Value / Face Value vs Market Value

Regardless of whether or not par value or face value is being used for bonds or for stock, it is a fixed value set at the initial offering of the security. As you may expect, since it is a fixed value, the relevance of par value on what is the true value of the security will be imprecise to minimal depending on the circumstances.

The true value of the securities will often be represented in their market value. This is because relevant information such as the creditworthiness of the company, the interest rate environment, their earnings, their future outlook, and so on will be taken into consideration by potential investors. The view of the investors will then manifest themselves in the prevailing market value of the securities over time.

We cover par value in more depth in our par value article.