Getting Debts Discharged

In short:

Bankruptcy is a legal avenue a person or business can use when seeking relief from debts when they are unable to repay their outstanding debts. The legal process typically begins with the debtor, who is unable to pay their debts, filing a petition with bankruptcy court. Occasionally, a petition will be filed on behalf of the creditor however this is not common. After this, all of the debtors’ assets are accounted for, measured, and may be used to repay all or a portion of outstanding debt. All bankruptcy cases are handled in federal courts in accordance with U.S. Bankruptcy Code. The goal of bankruptcy from the government’s perspective is to give a financial “fresh start” to debtors who otherwise could not overcome their debt.

Pro’s and Con’s of Bankruptcy

In-depth:

While in the ideal world there would be no need to think about filing for bankruptcy, there are some cases where it may be the only option. Depending on your situation and which type of bankruptcy you file for, you may be able to relieve your legal obligations to some debt while still retaining your home and regain some financial functionality.

That said, filing for bankruptcy comes with heavy costs that very often outweigh the reward of alleviating debt via bankruptcy. One such cost is damage to credit. If you have declared bankruptcy, this will be shown on your credit for anywhere from 7 to 10 years or potentially longer. When a future lender sees this they will likely not want to lend to you for the risk they might not be repaid.

Additionally, you give up control over what happens to your assets. Other people have stepped in to take care of the situation and resolve some or all of the issue for you but your say in how it is done can be very limited. The goal is a financial reset. Even if the debt is fully discharged you still have the credit issue hanging over your head.

Often the best course of action is contacting the lender and trying to negotiate a different payment plan that allows you to fulfill all or part of your obligation. With this approach, the lender is under no obligation to work with you or make adjustments however it is not uncommon for lenders to make some effort to do so. The advantage here is twofold, first, you may be able to prevent long-term damage to your credit by still upholding your obligation to pay your debt. The second is retaining some control over what happens to your assets. It may be the case that you still need to liquidate some, most, or all of your assets to make good on your debts, however, this approach would likely give you greater flexibility over how things are handled.

Generally, bankruptcy should be considered as a last resort option for most situations only pursued after all other options have been exhausted and after seeking the counsel of qualified trusted professionals.

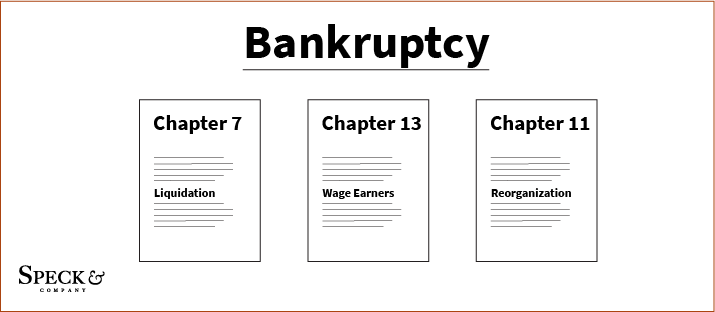

Types of Bankruptcy

Not all bankruptcy is the same and not everyone is eligible for the same type of bankruptcy. Depending on who is seeking bankruptcy and what condition they are in there are different types or chapters of bankruptcy they may file.

Chapter 7 – liquidation

For individuals – They usually have to have few to no assets in addition to a very low monthly income and must pass a “means test”. This type of bankruptcy does not include filing a repayment plan as other forms of bankruptcy would because all of the debtor’s non-exempt assets would be collected and sold to pay the debtor’s creditors. In addition, the debtor filing for chapter 7 would also need to receive credit counseling from an approved credit counseling agency before they can file.

For businesses – This type of bankruptcy provides for liquidation of assets to settle debt. Companies filing this type of bankruptcy are not attempting to restructure and remain in business.

Chapter 13 – wage earners plan

For individuals – Another name for this type of bankruptcy is “a wage earners plan”. The advantage of this form is it may allow the debtor to save their property such as their house by allowing for the debtor to submit a repayment plan to make payments to creditors over three to five years. Some debt may not need to be paid in full depending on which of the three types of claims it is. Priority, claims have a special status such as taxes or child support and must be paid in full. Secured, are claims that are backed by the right to the asset such as a house -the creditor must receive at minimum the value of the collateral in this case. Unsecured, are where the creditor has no special rights to collect any property of the debtor -these may not need to be paid in full. If you are using chapter 13 all your disposable income will likely be used to pay your debts during the three-to-five-year period.

For businesses – Businesses do not file chapter 13, instead, they file chapter 11.

Chapter 11 – reorganization

For individuals – not common

For businesses – This goal of this form of bankruptcy is for the business to reorganize its obligations while remaining in business and in control of its operations during bankruptcy. The company will provide a plan for reorganization, creditors whose rights are in subject will then vote on if they agree with the plan or not until an agreement is made. Investors or owners of the business do not have any of their personal property at risk other than their investment in the company unless the company filing for chapter 11 is a sole proprietorship in which case they do.

Debts not Discharged by Bankruptcy

Not all debts can be discharged by bankruptcy. The objective of the government by allowing for bankruptcy in the first place is to allow someone a financial fresh start but not at the entire expense of the creditor. They additionally don’t want to inadvertently provide a path to game the system and allow people to not make good on obligations where the creditor needs the funds or is intentionally being cheated out of the funds.

As such, common debts that cannot be discharged by bankruptcy include tax claims, debts for child support, debts for willful or malicious injuries to persons or property, student loans, debts owed to tax-advantage retirement plans, personal injury debts caused by the debtor operating a motor vehicle while intoxicated, and more.

Additional Resources

Taxes

If you are in a situation where you owe a large amount of back taxes seeking bankruptcy to discharge those taxes is likely not going to rectify the situation. A better alternative is to work with the Internal Revenue Service (IRS) to find a solution to your problem. Two general plans the IRS offers people are an IRS payment plan where you can make installment payments of the taxes you owe or an offer in compromise where you settle your taxes for less than you owe.

You can find more information from the IRS themselves with this link: handling taxes

Student loans

While it is generally true that you cannot get student loans discharged in bankruptcy. In some cases, with a very high bar to pass, it may be possible to get student loans to a more manageable state or discharge.

You can find more information on student aid bankruptcy discharge with this link: studentaid.gov

*Speck & Company is not in the business of providing legal or personalized financial advice. The information presented in this article is for informational purposes only and is intended as a high-level overview of the subject. Additionally, information gathered and presented in this article are from sources thought to be reliable, however, Speck & Company does not guarantee accuracy or completeness. If you believe you need to file bankruptcy, please seek guidance from a trusted financial professional and legal counsel.